- The S&P will be looking to rebound from a three week losing streak as we kick off the busiest week of earnings season.

- Overall the market has now gone through a 5% correction. This is something that occurs three times a year on average. However, when you live through it, it’s never fun.

- The question now becomes is this a garden variety correction or is there something more to it?

YOUR WEEKLY ROADMAP

The S&P will be looking to rebound from a three week losing streak as we kick off the busiest week of earnings season. Overall the market has now gone through a 5% correction. This is something that occurs three times a year on average. However, when you live through it, it’s never fun.

The question now becomes is this a garden variety correction or is there something more to it?

Outside of earnings, other topics to monitor will be continued geopolitical concerns in the Middle East, impacts (if any) on the bitcoin halving and of course the Fed’s preferred inflation gauge in the PCE.

How Low Do We Go? We dropped below the 50-day moving average and that nice round 5000 number in the index. We have officially hit the 5% correction, so what are we watching now?

The chart above includes Fibonacci retracement levels which can act as levels of support and resistance. They are far from an exact science but more often than not they act as a consolidation area in price action.

If we can’t recapture the 5000 mark this week, then another leg lower is probable. Downside targets of 4800 are likely. That would bring the index almost even for the year and back to its old resistance levels prior to our latest rally.

If momentum surges to the downside this would likely be a great buying opportunity. A 10% drop takes us to the 200-day moving average at 4674. Any washout to this level and below brings us to a great area of support around 4600 and a great place for dip buyers to jump in.

Looking for a bottom. Last week the S&P 500 opened higher every day and then reversed course to close lower each day. This is not good price action. Traders want to experience a sell first event and a washout before sounding the all clear. There has yet to be a sense of panic, a super spike in the VIX and a surge in volume behind the moves.

For now the market reaction has been tepid at best. Investors are selling the rallies as fears of more potential geopolitical risks weigh on their minds.

The best bottoms are formed when market breadth is fiercely negative and we get a reversal off the lows of the day. We are getting negative breadth, but the selling is too methodical at this point to expect a quick and powerful reversal.

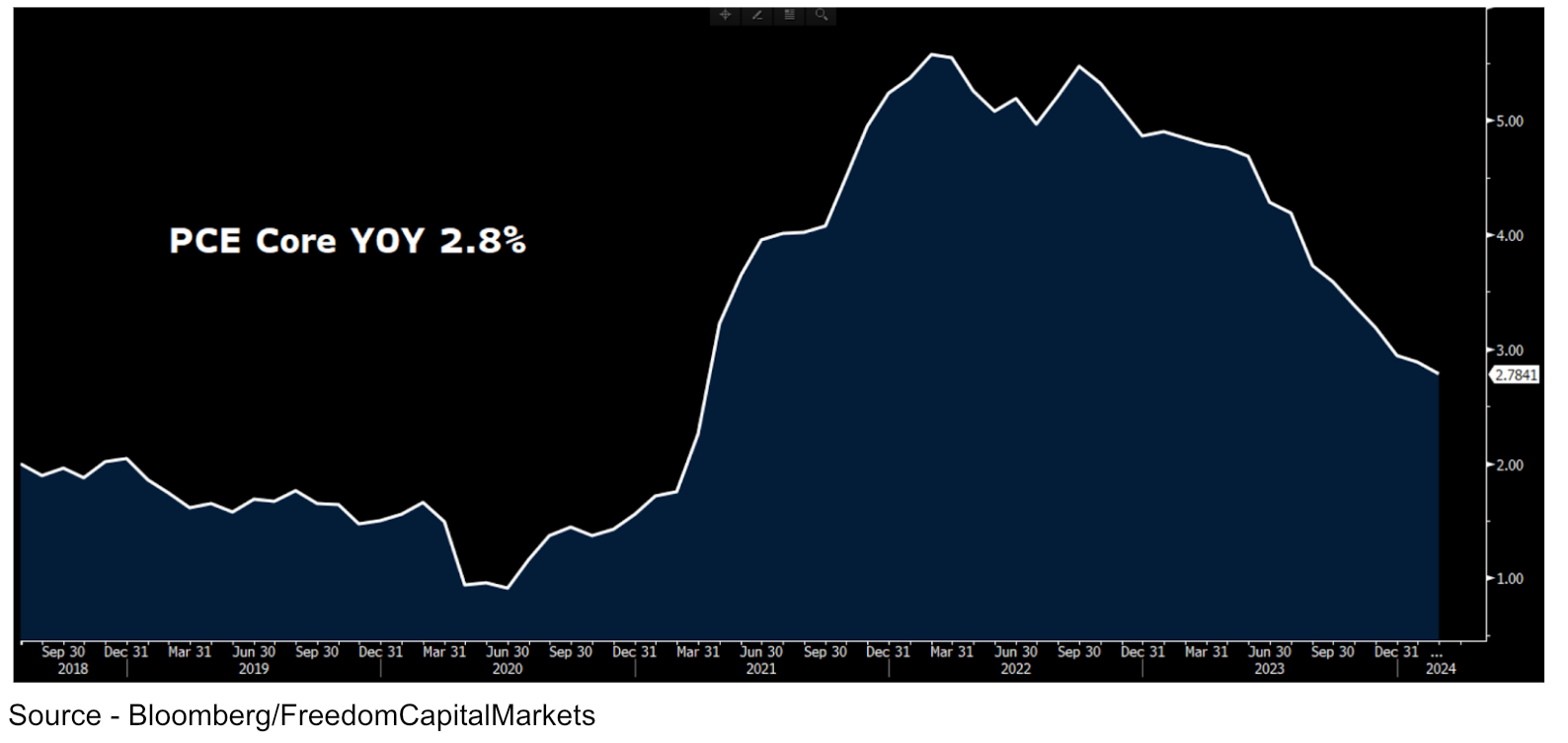

Personal Consumption Expenditures (PCE) known as the Fed’s preferred inflation measurement - is expected to drop from 2.8% year-over-year to 2.7% when released on Friday.

The Fed prefers this inflationary measure more than the CPI because it covers a broader range of spending. Unlike the CPI and PPI numbers, we haven’t had many upside surprises in the PCE as it continues to slowly trend lower.

A PCE number in line with expectations may be the last hope to see a rate cut by June. Most other economic indicators have remained sticky, yet the PCE hasn’t seen an uptick at this time.

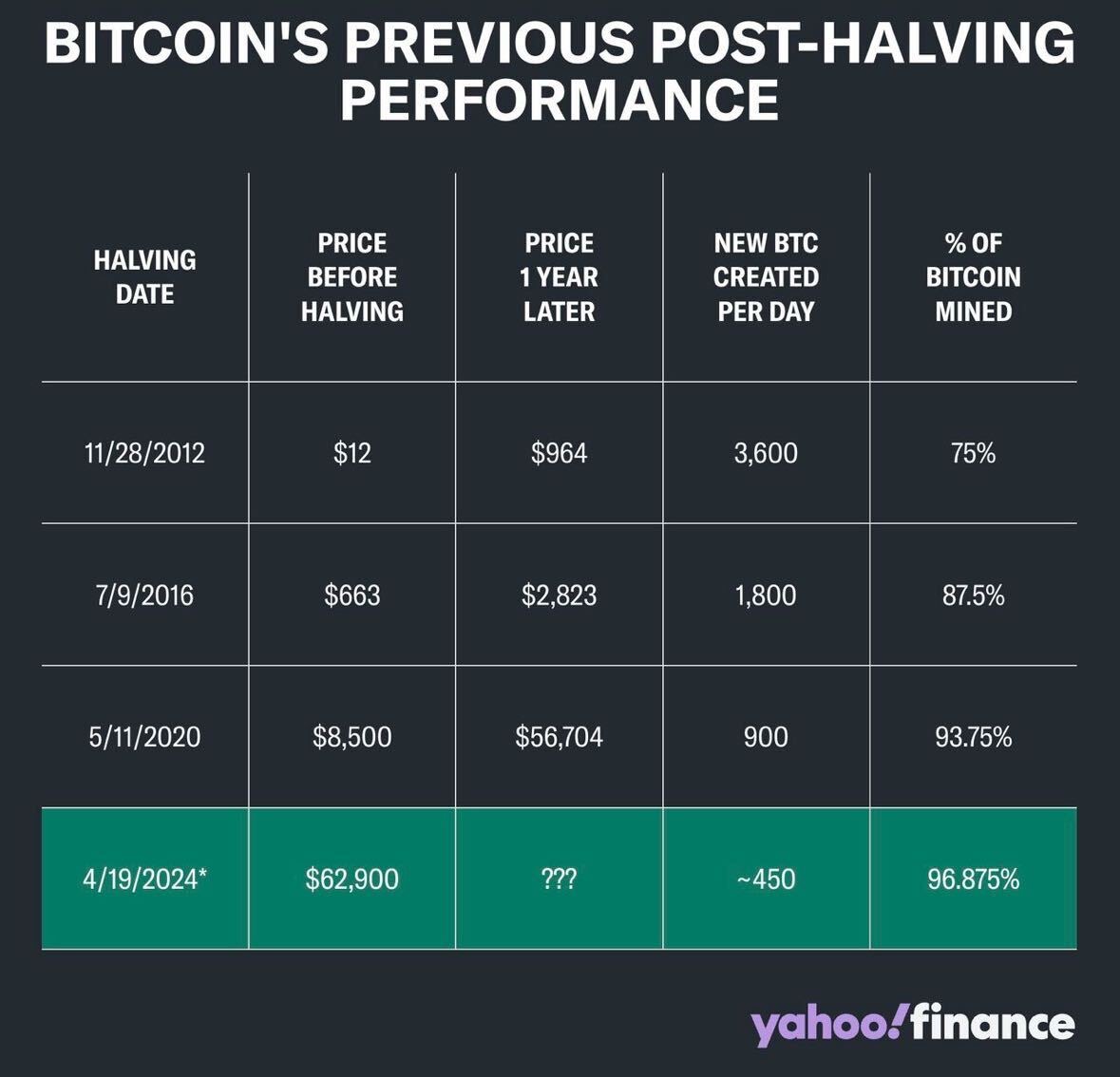

Bitcoin - The “halving” is expected to occur on April 19th or 20th - yes, either on the 19th OR 20th. This is yet another reason why the idea of crypto confuses me and I am far from an expert on the topic.

So what has the post-halving world looked like for Bitcoin? Thanks to YahooFinance for sharing the below data. As you can see one-year after halving the cryptocurrency has dramatically increased each time. Granted the sample size of three is quite small, but it is worth noting the results.

As for bitcoin I do follow the trends and the underlying results of those assets that trade in equity form.

Expect volume and volatility to surge in miners such as Marathon Digital (MARA), Riot Platforms (RIOT), Iris Energy (IREN) and CleanSpark (CLSK) as well as the platforms that trade crypto like Coinbase (COIN) and Robinhood (HOOD).

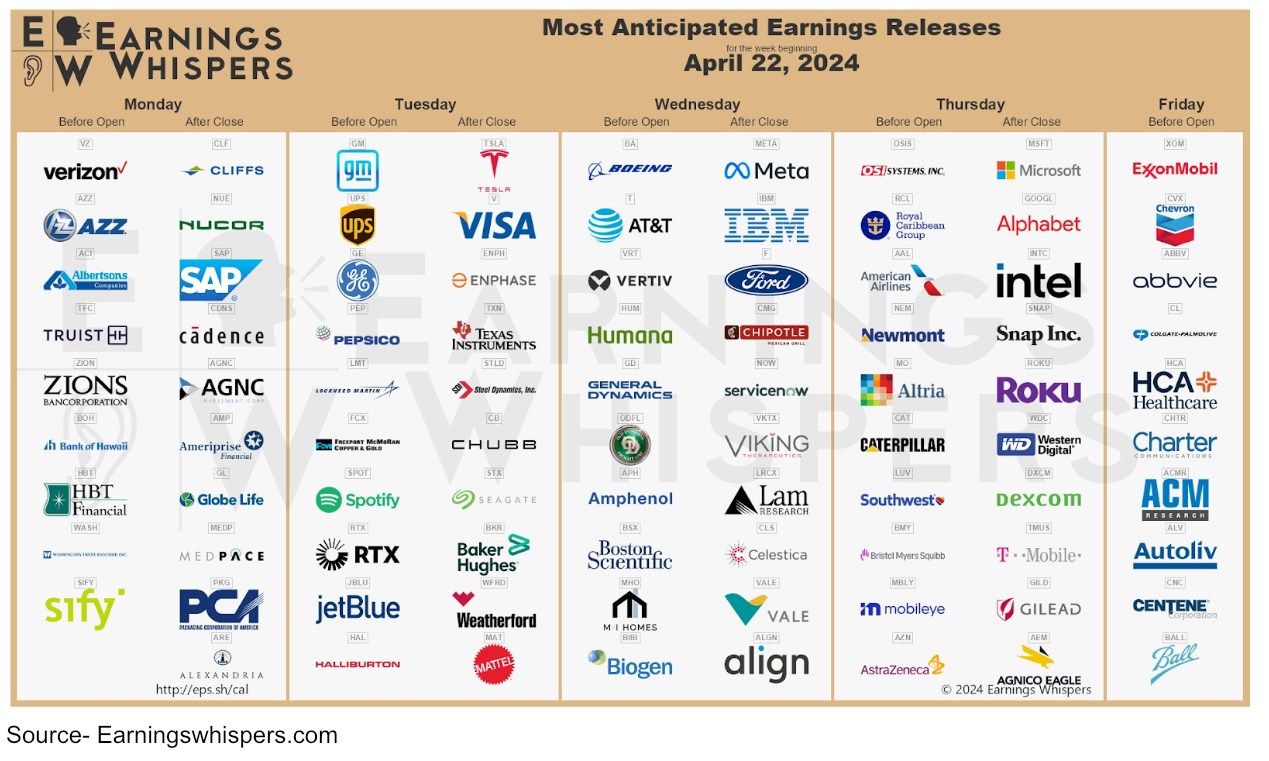

Magnificent Earnings? This week we get four of the top seven names in the world reporting.

One of these stocks below is not like the other. One of these stocks doesn’t belong? Can you guess which one?

Of these four stocks, only one of them is down for the year. If you guessed Tesla then you made the right call. We discuss below.

Earnings. Other than the megacaps above, we have several giants of the S&P 500 reporting. Highlights include Verizon (VZ), Visa, IBM, Humana (HUM), Intel (INTC) and ExxonMobil (XOM).

Stocks in Focus…

Autos - General Motors (GM) and Ford (F) both report this week. So far this year GM has been the standout of the two U.S. car manufacturers as its up 18% YTD vs a flat return for Ford.

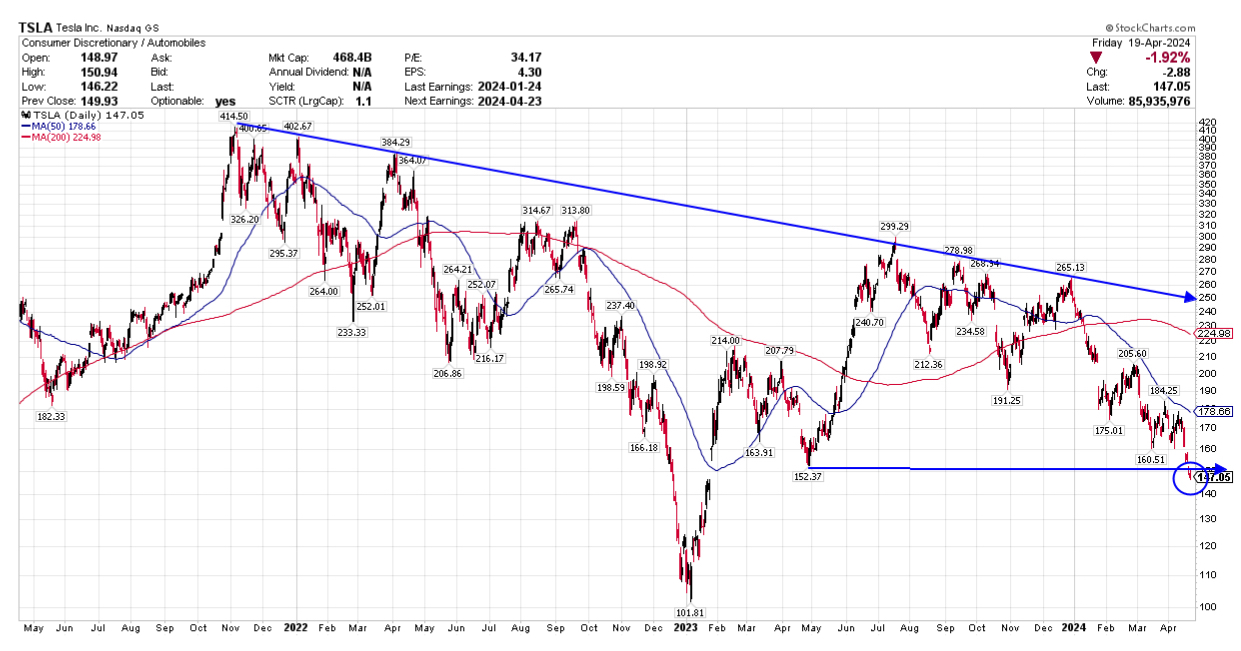

Tesla (TSLA) has missed analyst expectations over the last four quarters and shares have dropped an average of -10.2% after each of those reports. Going into Tuesday afternoon’s report shares are down over 40% year-to-date and trading at 52-week lows.

Deliveries continue to underwhelm. Pricing pressures and competition grow. Recent rumblings that they may scrap their Model 2 line as well as a recall on the cybertruck have added pressure on share price.

Technically, the stock has been mired in a 2½ year long downtrend that has recently accelerated. As we head into earnings the stock is testing an intriguing support area at the $152 area. It’s almost a carbon copy of its decline in 2022. Another negative quarterly result could lead to an accelerated leg lower to as far as $100.

Any positive result could see a pop to its declining 50-day moving average around $180 where price has been met with consistent selling pressure for months.

Always be cognizant of after hours price action. The initial reaction doesn't always equate to the direction after the earnings call. The last two earnings calls have been “disasters” in the words of Wedbush analyst Dan Ives. Things tend to be volatile and you never know what Elon Musk is going to say next.

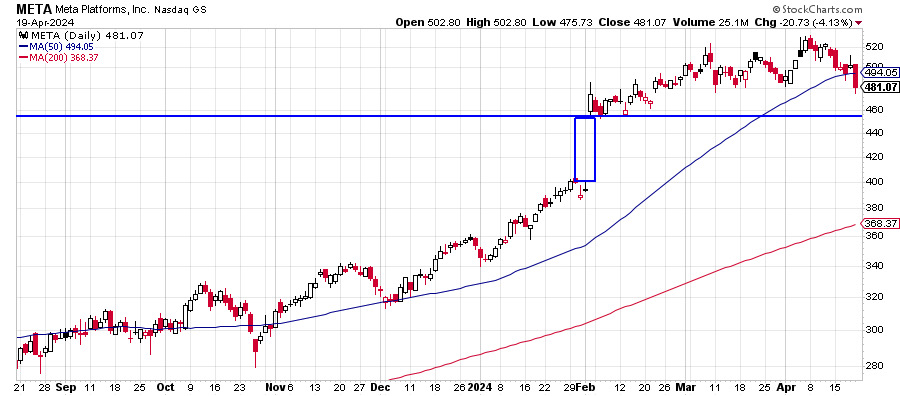

Meta Platforms (META) shares have been on a great earnings run over the last year. They have eclipsed expectations four times in a row and have traded higher by an average of 11.6% after its last five reports.

Technically shares have been under pressure given the recent market drawdown. Watch the $450 level to act as support on a further pullback. That is the gap taken after last quarter’s positive result. If it fails to hold that gap there is tremendous downside risk to the $400 level.

To the upside, watch the old highs at between $520 - $530 to act as resistance. One common theme early on this earnings season is that solid beats are not getting rewarded with strong upside moves. Maybe a strong beat by META can change this narrative.

Microsoft (MSFT) has delivered positive earnings surprises after their last six reports. However shares have only rallied on two of those occasions.

The most heavily weighted stock in the S&P 500 is up 6.1% YTD. Investors will be focused on growth in the AI space. So far this cycle, the AI related plays have yet to take stocks higher.

Technically shares have retreated from their all-time highs and are sitting on near-term support at the $395 level. Any further downward pressure could see shares drop towards its rising 200-day moving average at $366.

A rally, like I mentioned with META, could take it to its old highs. However, can it push through? That will be the big question on any beat and solid guide.

Economic Calendar

Tuesday - New Home sales 10:00

Wednesday - Durable Goods Orders 8:30

Thursday - GDP Q1, Initial Jobless Claims 8:30

Friday - PCE Index 8:30

THE WEEK THAT WAS

Geopolitical concerns remained a major cloud hanging over the market all week. The Iranian attack on Israel the prior weekend and the anticipated Israeli response was the talk of the floor.

On top of that, earnings reactions have been lukewarm at best. The stocks that beat manage to hang on to recent gains, but fail to take a new leg higher. Those that are falling short of their targets or issue weak guidance have gotten punished. The worst performers have been those in the technology sector.

In fact, it was the worst week since October 2022 for the Nasdaq.

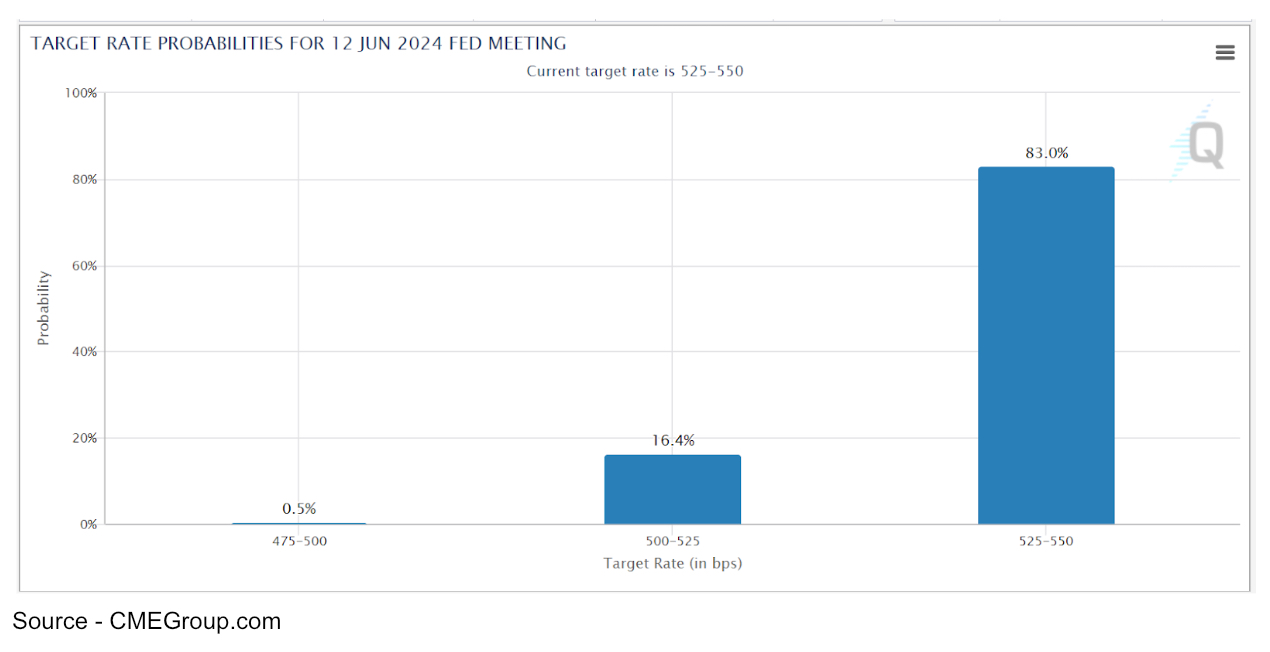

Fed Chair Jerome Powell also threw cold water on the thought of any rate cut as he pivoted slightly in his tone last week. He stated that “the recent data have clearly not given us greater confidence”. He said that the Fed will keep the course for “as long as needed” which made the reality of a rate cut by June less plausible.

We also saw the 10-year yield spike above 4.7% which was its highest level since September as it made its run to 5%. When that spike occurred the market sold off 10% before bottoming. So keep an eye on the 10-year because if we see any more of a spike towards 5%, it could expedite the current sell-off.

Fed Speak. Jerome Powell wasn’t the only voice at the Fed throwing cold water on any potential rate cut last week. Bloomberg put together a great series of quotes (below) highlighting key Fed officials thoughts on current policy.

The general consensus remains to wait and see until they can get more clarity on rate cuts. After last week the odds of a June cut dropped to its lowest level this year at 16.4%. This week the Fed speakers are in their quiet period ahead of the May 1st meeting. So things shall remain calm until Friday’s PCE number.

Semiconductor Stocks Get Hit. ASML Semiconductor (ASML), one of the world’s largest chip makers dropped over 6% after missing quarterly estimates for orders. It is the fourth largest holding in the VanEck Semiconductor ETF (SMH) behind Nvidia, Taiwan Semi and Broadcom.

Taiwan Semi (TSM) shares dropped -10.4% on the week after they scaled back its 2024 market outlook. While beating expectations on the street, they warned that smartphone weakness could offset growth in AI.

Weak guidance started an avalanche of selling in the space that hit a crescendo on Friday. The top two AI chip making stocks in Nvidia (NVDA) and Super Micro Computer (SMCI) lost -10% and -23.1% respectively. Despite those severe drops, the stocks are still up 54% and 151% year-to-date.

STOCKS IN THE NEWS

Airlines. United Airlines (UAL) and Alaska Air (ALK), like Delta (DAL) the week before, posted earnings that topped analyst expectations. All of the major airlines continue to believe that this summer travel season will be another one for the record books.

As a result it was one of the best performing sectors during a very challenging week. Shares of UAL gained 22.9% to close at $51.38, ALK jumped 9% to finish at $45.01, and DAL bumped 1.5% to finish at $47.57.

Netflix reported a quarter that smashed analysts' expectations on both the top and bottom lines. However, shares dropped as investors focused on a weak revenue forecast as well as the news that the company would no longer issue future guidance on their subscriber growth.

As a result, shares dropped close to 10% to close at $555.04. As we mentioned last week, after their last three reports shares have continued to trend in the direction of its post-earnings gap. Hopefully for the NFLX bulls, this trend ends shortly.

United Healthcare (UNH) had traded down to its 52-week lows as it approached its quarterly numbers. They beat on both the top and bottom lines as well as confirmed their 2024 outlook despite fears of rising Medicare costs and recent cyber attacks to their network.

For the week shares gained 14.1% to close at $501.13. It is the largest component in the Dow Jones Industrial Average and its $51.38 gain this week contributed 406 points to the index. That was good enough to keep it in positive territory on its own.

American Express (AXP) crushed their earnings estimates thanks to a strong consumer that continues to spend. Travel and leisure remains the strongest area. Shares jumped 6.2% to close 50 cents away from an all-time high.

Heat Map. Megacaps and technology stocks suffered their worst weeks since last October as momentum selling accelerated into Friday’s close.

Despite that wave of selling there were a few pockets of strength in the financials, staples and utilities.

MARKET STATS

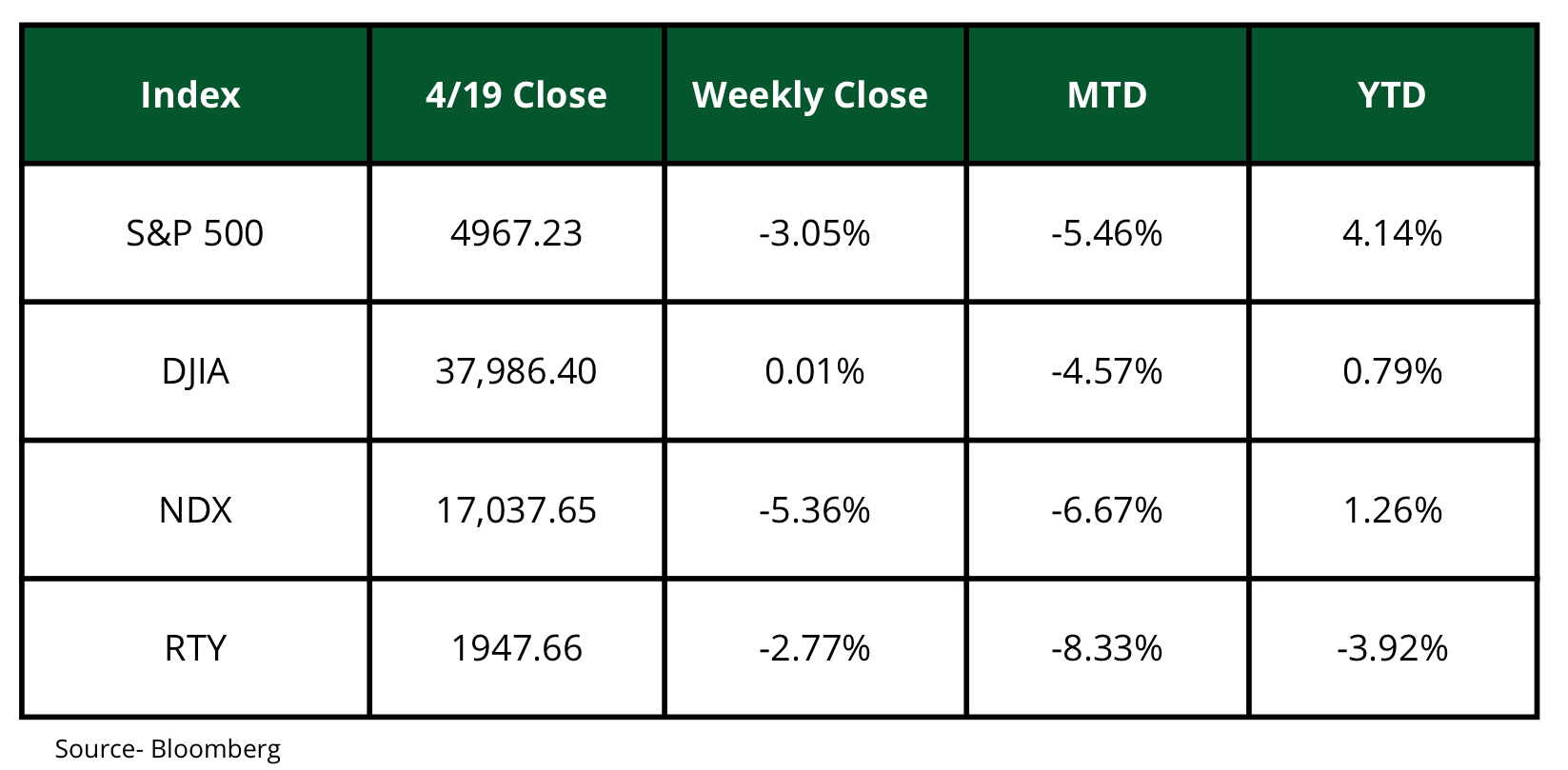

The S&P 500 and Nasdaq 100 finished the week lower every day last week. When the dust settled the indexes closed lower for the third consecutive week.

The Dow was an outlier thanks to its price weighted nature and a great week from its largest component in United Healthcare. The stock alone kept the index positive for the week as it accounted for most of its gains.

SECTOR WATCH

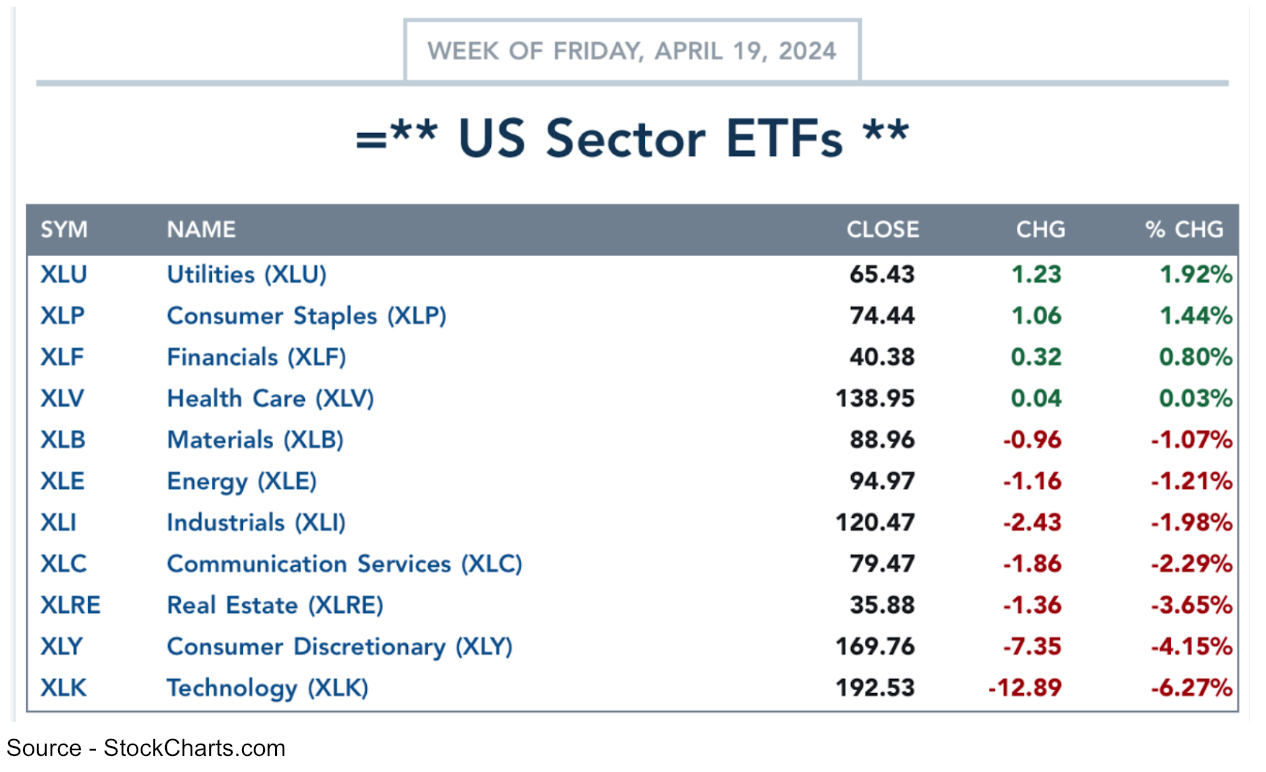

Investors got defensive this week as Utilities (XLU) and Consumer Staples (XLP) both gained over 1.4%. Financials (XLF) also managed to eke out a gain thanks to strong earnings, but even those results couldn’t lift it much higher than its 0.8% jump.

Technology (XLK) was hit the hardest for the second straight week. A big drop in the semiconductor sector led to the sector's biggest drop since October 2022 as it fell by -6.3%.

Shared content and posted charts are intended to be used for informational and educational purposes only. CMT Association does not offer, and this information shall not be understood or construed as, financial advice or investment recommendations. The information provided is not a substitute for advice from an investment professional. CMT Association does not accept liability for any financial loss or damage our audience may incur.