- While the losses have been marginal, it certainly feels that the tide is turning over the near term. Technology and small caps are bearing the brunt of the recent downturn but their weakness hasn’t been enough to take the S&P much lower.

- This week’s big story will be Wednesday’s FOMC meeting and the Fed’s press conference that follows. Other events to keep an eye on include a high profile IPO and Nvidia’s GTC Conference.

YOUR WEEKLY ROADMAP

We kick off Monday’s trading session riding a two-week losing streak in the S&P 500. We haven’t experienced back-to-back weekly declines since October. However, the declines have been minimal as the index has lost less than 20 points over this time, or roughly 0.38%.

While the losses have been marginal, it certainly feels that the tide is turning over the near term. Technology and small caps are bearing the brunt of the recent downturn but their weakness hasn’t been enough to take the S&P much lower.

This week’s big story will be Wednesday’s FOMC meeting and the Fed’s press conference that follows. Other events to keep an eye on include a high profile IPO and Nvidia’s GTC Conference.

Watch the 10-Year… last week the 10-year surged on hotter than expected inflation data closing above 4.3% for the first time in a month. It is now pushing back to its February peak and could eclipse that mark based on the Fed’s commentary.

So far the market has remarkably absorbed the slow and steady rebound in rates. The S&P 500 was trading at 4800 when the 10-year bottomed at 3.78%. Now the index trades just over 5100 while the 10-year climbs higher.

Last week’s rally in the 10-year hit the rate sensitive stocks in the Russell and technology the hardest. Any spike higher should have inverse effects on the S&P 500. A sharp move above 4.35% and expect the market pullback to accelerate and test that 5000 mark again.

FOMC Meeting - There is no expectation of any action by the Fed this week as they meet to discuss the current path of interest rates. The focus will be 100% on their official statement and the subsequent press conference at 2:30.

There seems to be more anticipation of Wednesday’s FOMC meeting than usual after this week’s hotter than expected CPI and PPI numbers. Will this change their narrative when it comes to a cut by June? I spoke about that here with Maria Bartiromo on Friday.

Clearly a pause is in order for the fifth consecutive meeting, but what does it mean for meetings going forward. Will Jay Powell’s usual talk of “one data point at a time” continue or will he acknowledge things are getting sticky. Will his slightly dovish tone turn slightly hawkish?

Given recent sticky inflation data there could be a tone change that may go cautiously hawkish and provide the Fed some wiggle room if they had to mull a raise. I seriously doubt they will take this tact and suspect Powell will stick to his recent narrative from his Capitol Hill testimony when he stated we are “close” to a rate cut.

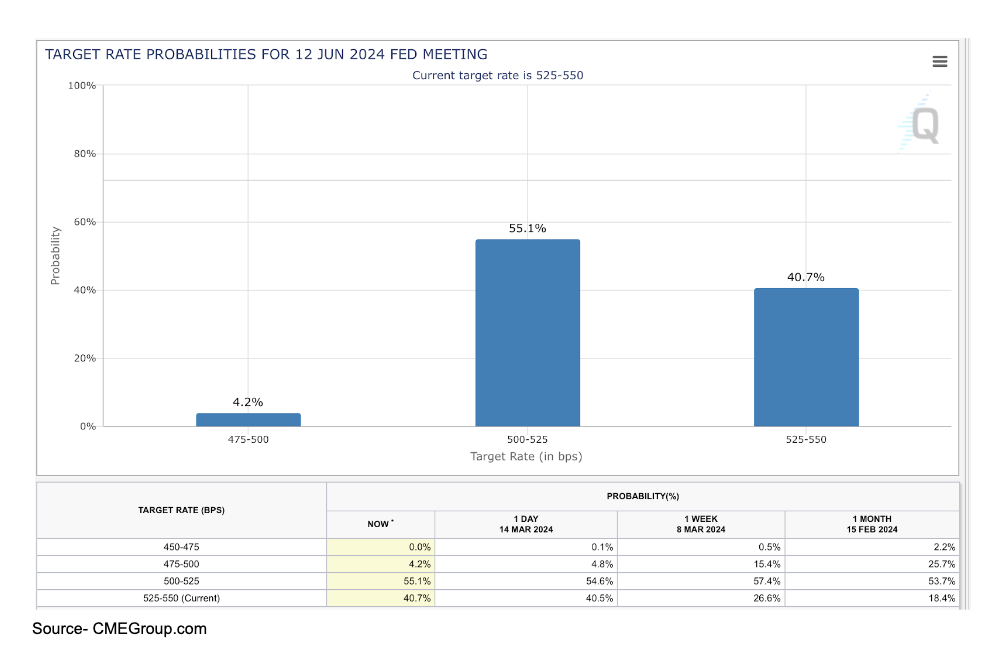

According to the recent CME target rate probabilities, the likelihood of a May cut is under 7.5%. June (chart above) seems to be the focus and now the chances of a cut are still elevated at 60% but that is down from just over 80% a month ago.

At this time the market has absorbed a higher for longer narrative despite the surprisingly hotter numbers over the last two months. Watch the small caps closely to see if they can hold on to recent gains without a cut projection in the near future.

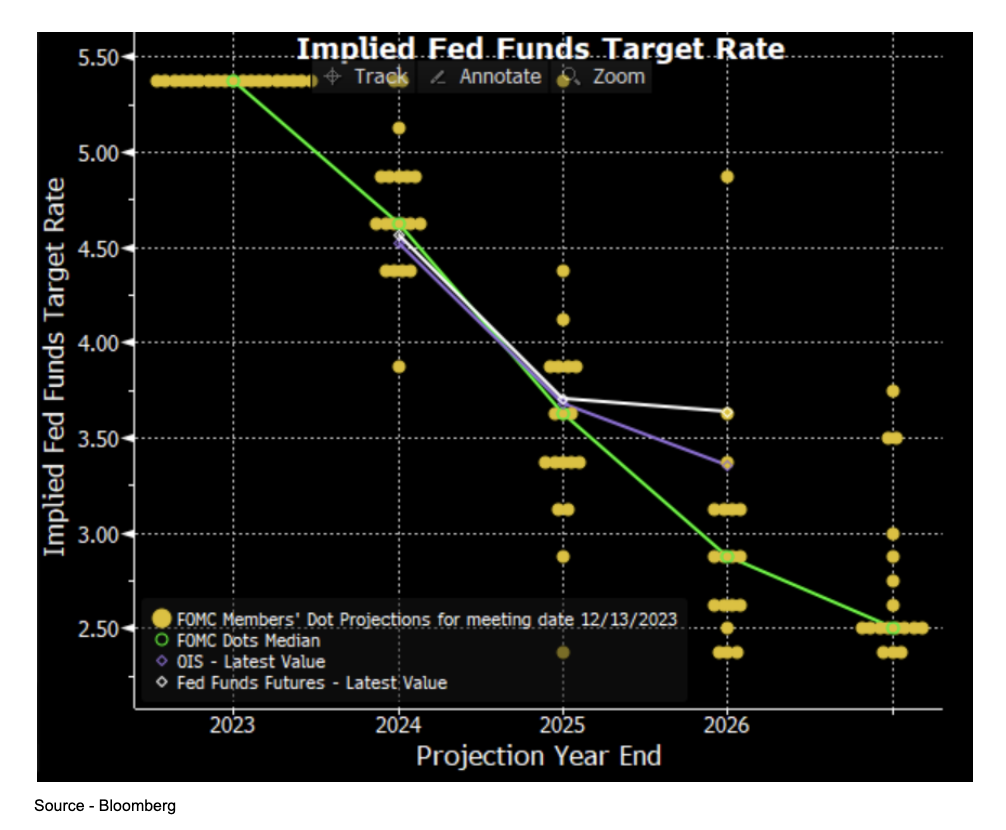

Watch the Dots… We will also get the latest dot plot reading after this week’s meeting. The dot plot is a chart updated quarterly that records each Fed members official projection as to what the appropriate federal funds rate will be at the end of each calendar year.

The last dot plot showed the average official saw two to three rate cuts from by the end of 2024. Let’s see if they remain at these levels or if something has changed.

Reddit IPO. The long anticipated debut of the online discussion platform will begin trading at the New York Stock Exchange on Thursday morning under the ticker RDDT. The 18-year old company plans to sell 22 million shares between $31-$34. That would equate to roughly a $6.4 billion valuation.

The significance of this IPO will not be lost on all those unicorns anxiously waiting to test the market. If Reddit’s debut goes smoothly and is well received by the street, look for a flood of IPO’s to jump into the waters.

Conditions continue to be favorable as the market sails along near all-time highs. A strong showing by RDDT could see an opening of the IPO pipeline. Other high profile names that are rumored to possibly go public in 2024 include Fanatics, Shein, Skims, Plaid, Klarna, Vuori, Discord and Chime.

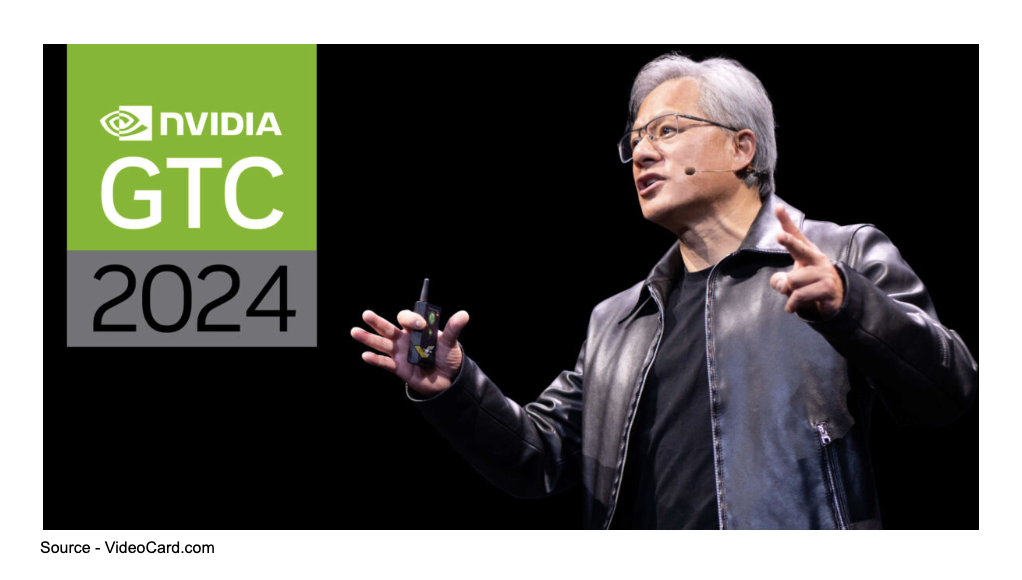

Nvidia GTC Conference. On Monday afternoon at 4:00 PM EST Nvidia CEO, Jensen Huang, will deliver his keynote at the company’s annual conference. The potential two-hour long address will be held at a packed SAP Center in San Jose and streamed by hundreds of thousands worldwide.

The stock continues to be the talk of the markets as its valuation has eclipsed the $2 Trillion mark making it the third largest U.S. company trailing only Apple and Microsoft. Shares are up 79% YTD and 267% over the last 52-weeks.

Investors are hoping to hear about their next generation of AI chips and any potential new partnerships. One name rumored to be working with Nvidia has been Oracle. Hundreds of exhibitors are expected to take part in the three day expo. Presenters include representatives from Meta, Microsoft and OpenAI.

We expect many headlines to come from the event. An even bigger question is can the stock keep its momentum going seeing that shares have gained every week so far in 2024.

Earnings. The wave of earnings reports has turned into a trickle. Yet there are still a few earnings reporting to quench the thirst of traders looking for action.

Stocks in Focus…

Nike (NKE) shares have yet to gain any solid traction over the past year. Shares are off -8.2% YTD and lower by -16.1% over the last 52-weeks. The Dow component hopes to reverse recent trends when it reports Thursday afternoon.

Technically, keep an eye on the 200-day moving average. This is a good barometer of the stocks overall health. It continues to trade below the average and fails to maintain any momentum when it eclipses the mark.

A good first step for price recovery would be a break and hold above the mark. The good news is that the stock continues to make higher lows when it does sell off. The bad news is that each rally has been met with much resistance.

On a rally, watch the gap from the December earnings miss at $107.50 to try and fill. If shares take another leg lower, support around $94 from the October gap could be a good entry point. If that fails to hold then watch for a potential re-test of the October lows around $88.

FedEx (FDX) shares have been stuck in neutral (circled in chart) all year since missing its earnings estimates last quarter. Shares dropped 12.5% on that news and hope that Thursday’s numbers turn things around.

Technically, you can see the gaps in the chart that have been caused by earnings surprises. The average move post earnings is +/- 5%. A positive reaction should see the stock climb back towards its 52-week highs around $284. A negative reaction and watch for a re-test of the recent lows around $235.

Micron (MU), the Idaho based chip maker - that’s semiconductor chips, not potatoes - has been on a tear as it heads into Wednesday’s earnings. Shares are up 10% year-to-date and 74% over the last 52-weeks.

Technically, let’s look at this chart above on a longer term basis. This is a 5-year weekly chart and as you can see, we are at a very interesting threshold. Shares have made the full roundabout from its old peaks going back to 2021/22 and are now poised to go higher.

We have seen these trends in many of its peers and a solid report could ignite the breakout and see a nice follow through to the upside. A negative surprise and watch the recent lows at $80 to be tested.

Economic Calendar

Tuesday - Housing Starts 8:30

Wednesday - FOMC Decision 2:00, Press Conference 2:30

Thursday - Jobless Claims 8:30, Existing Home Sales 10

THE WEEK THAT WAS

Reaction to inflation data was the talk of the markets as the prospect of future rate cuts may be pushed back even longer than many expected.

The other big story is the ongoing debate over the future of TikTok and their owner ByteDance. The House of Representatives weighed in on a bill to ban the app in the U.S. or force the company to divest its China operations. Expect this story to remain in the headlines for weeks to come and also be a pivotal topic in the upcoming Presidential election.

Consumer Price Index (CPI) and Producer Price Index (PPI) numbers came in stronger than expected. The headline CPI, which excludes food and energy, was released on Tuesday and came in at 3.2% vs an expectation 3.1%. The core number decreased year-over-year from 3.9% to 3.8%, but was still slightly higher than the expected 3.7% number.

The bigger surprise early in the week was the market’s ability to initially shake off a hotter number and rally higher. After a two-day sell-off going into the numbers, the market did not appear shell shocked by the slight uptick.

The PPI numbers also came in hotter than anticipated on Thursday. The initial reaction was muted as markets opened higher. However, they reversed course as the interest rate sensitive stocks led a thrust lower. The sell-off erased all weekly gains and we closed lower across all the major indices.

TikTok Ban? On Wednesday the House passed legislation in a bi-partisan vote that would ban the Chinese social media app from operating in the U.S. or force a sale. The bill goes to the Senate next where it may face an upward battle, but if passed it is expected that President Biden would sign the legislation.

The bill calls for its parent company ByteDance to divest itself of the platform within six months or be banned from all app stores and platforms in the U.S. The news leaves us with many more questions than answers.

China, a communist government, reacted to the news calling the vote a violation of freedom of speech. Legislators that voted in favor of the ban highlighted security and privacy issues. Traders wanted to focus on what stocks would be impacted the most by this decision.

Stocks Affected… The biggest beneficiary of a TikTok ban would likely be Facebook’s parent company, Meta Platforms (META). Ironically, Facebook has been banned in China since 2009. Now through their Reels platform they may see significant traffic migrate to their platform. Other beneficiaries for content would be Snapchat (SNAP) and Rumble (RUM).

However a ban could cause retaliatory strikes by the Chinese government against other technology companies that are major players in China. Shares of Apple and Tesla both sold off on the news as much of their revenue comes from China. Given how high profile both companies are, expect them to be in the crosshairs if there is blowback.

Who Could Buy Them? Given the sizable valuations of TikTok, there aren't too many potential suitors with deep pockets. The likely names are the megacap tech stocks that it competes with today. Those names include Meta, Apple, Microsoft and Alphabet.

However, given the regulatory scrutiny that thwarted smaller deals like Spirit Airlines and JetBlue, the thought that a deal of this magnitude would clear such hurdles is tough to imagine.

One wild card came in the form of former Secretary of the Treasury, Steve Mnuchin, when he told CNBC that he and a large group of private investors would seek to make a bid for the company. Other large investor groups have also been mentioned as potential suitors including former Activision CEO, Bobby Kotick and OpenAi CEO, Sam Altman.

While some of these scenarios seem like long shots, it may be another way this could possibly happen and yet another one of many twists to come in this ongoing saga.

STOCKS IN THE NEWS

Robinhood (HOOD) shares surged to their highest levels since December 2021 after the trading platform reported a surge in trading volume. The growth was in all asset classes and not just due to the resurgence in crypto trading.

Over the last month the company reported a 36% increase in equity trading, 12% growth in options trading and 10% in crypto. Shares rallied over 5% on the news and finished the week up 6.8% to close at $18.15. Shares are now up 42.5% YTD.

Boeing (BA) shares remained under pressure falling -8% for the week, and it is now the worst performing stock in the Dow as its lower by -30% YTD. They have yet to recover from the Alaskan Airlines (ALK) incident in which one of its doors blew off in mid-flight.

Investigators remain in the dark as to who was responsible for the repair work gone wrong. Their absence of records of the repair complicates the NTSB’s ongoing investigation into the company. Also complicating matters was the loss of the key whistleblower in the investigation.

John Barnett, a 25 year veteran of the company, was in the process of testifying against Boeing. Shockingly, he was found dead after an apparent self-inflicted gunshot wound. His suicide is being met with much skepticism and just becomes another twist in this on-going saga against the world’s large airline maker. You can read more here.

Adobe (ADBE) shares plunged 15% after giving a weak sales outlook. Revenue expectations were also projected below analysts targets.

Competition is keeping the company under tremendous pressure since peaking in early February. News of Microsoft-backed OpenAI’s plans to launch a competing text-to-video generator just months after Adobe’s introduced their own AI powered editing system put pressure on shares earlier in the year and now competing AI platforms are also cutting into further growth projections.

For the week shares were lower by -10.7% to close at $492.46. It was the stock’s lowest close since June of 2023 and it has now suffered a decline of -17.5% YTD.

MARKET STATS

The S&P 500 and the Dow closed fractionally lower for the week. This marked the second straight week of losses in the SPX; something we haven’t experienced since last October.

The Russell was the biggest laggard as hotter than expected economic data in the CPI and PPI kept the talk of rate cuts on the back burner for now. The higher for longer narrative has a much deeper impact on the small caps and as a result they gave back most of their recent gains.

Fun Fact - Thanks to my friend Brain Lund who shared this factoid with me via X. We all know the S&P 500 has been on quite a run as it has closed higher 16 of the last 20 weeks gaining 24% over this stretch.

The amazing fact is that even the downturns have been minimal. So minimal it continues to trend above some key averages for lengths not seen in decades.

As seen in this long-term weekly chart above, the last time the index went this many weeks without an INTRAWEEK dip below the 8-week EMA (estimated moving-average) was in 1995.

So is this run historical?

Why yes, yes it is. In fact, 1995 was the true breakout and the beginning of an epic bull run later dubbed the dot.com bubble. Could this be the beginning of the AI bubble? Possibly, and if so, we are still in the early innings.

SECTOR WATCH

Energy (XLE) led all sectors with a 3.8% gain thanks to a continued climb in crude prices that topped $80 a barrel. Materials (XLB) also remains a recent standout as it continued its rally with another 1.6% gain.

Real Estate (XLRE) gave back all of last week’s gains and was the biggest laggard of all sectors. Overall seven of 11 sectors finished lower on the week.

Shared content and posted charts are intended to be used for informational and educational purposes only. CMT Association does not offer, and this information shall not be understood or construed as, financial advice or investment recommendations. The information provided is not a substitute for advice from an investment professional. CMT Association does not accept liability for any financial loss or damage our audience may incur.