- Bearish Divergences in Option Prices The CBOE Volatility Index (VIX) measures the relative price of options being paid for current prices of options on the S&P 500 Index (SPX)

- These […]

Bearish Divergences in Option Prices

The CBOE Volatility Index (VIX) measures the relative price of options being paid for current prices of options on the S&P 500 Index (SPX). These indexes have an inverse correlation, so if one goes up, the other goes down.

For most of the time, this inverse correlation holds. But when something unusual occurs in the options market, that correlation may diverge for brief periods. Such periods can be important warning signals.

To make the comparison easier to see it is better to use an inverse-VIX ETF, such as Volatility Shares’ Short VIX Futures ETF (SVIX). When you compare SVIX and SPY the line charts should look highly similar. Lately they have looked very similar right up until the past couple of weeks.

This chart attempts to equalize the scale of both instruments in such a way that any separation of the two tickers will show up in a clear manner. Here you can see that over the past month, SVIX has been trending lower, even while SPY achieved a new all-time high.

This bearish divergence signals that option buyers should be wary about entering new positions right now. Market jitters may be just beginning.

Sector Analysis Shows Inflation Influence

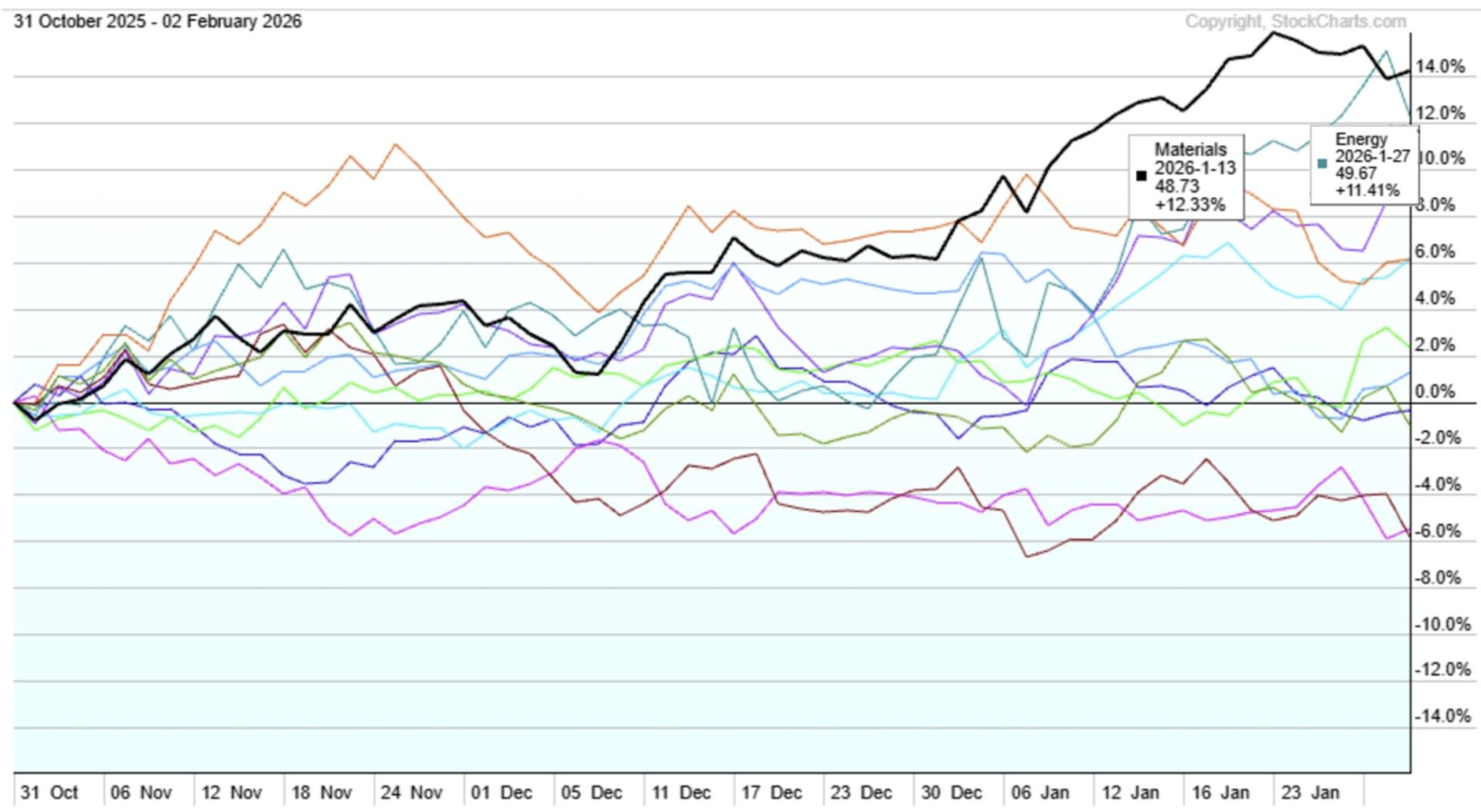

If you need any more confirmation of the market’s untenable situation, a simple glance at the sector rotation pattern will suffice. Reviewing the chart below reveals that two sectors in the past three months have led out. But they aren’t the sectors you might have expected.

During times of market booms, the leading stocks often come from recognized growth names. Stocks behind the household brands have often been thought of as the leaders of the markets.

What most investors would NOT expect would be any one stock from the Basic Materials sector and another from the Energy sector. When these inflation sensitive sectors lead, it indicates something very different.

That’s Not a Good Thing

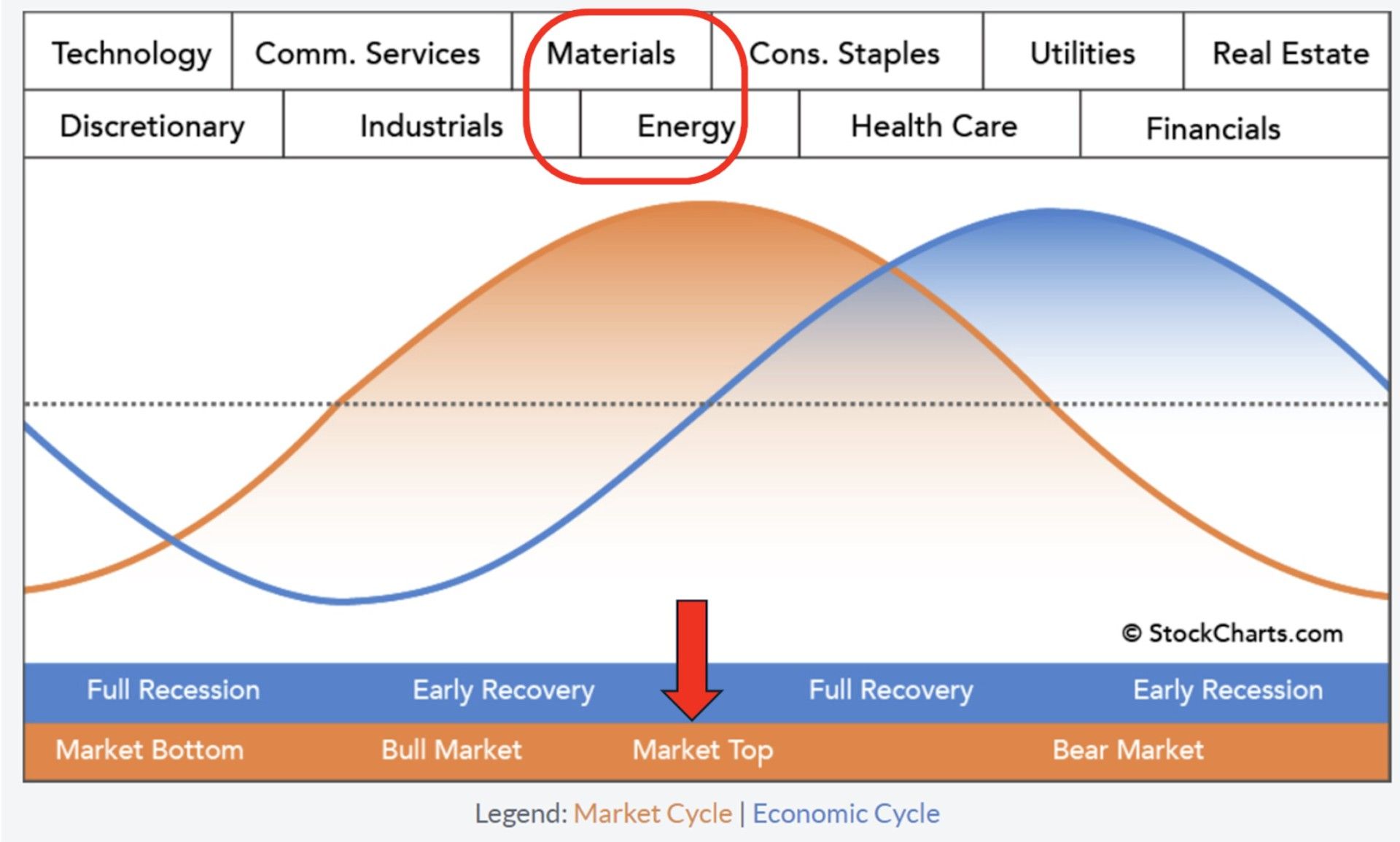

Thirty years ago notable market analyst Sam Stovall first published his sector-rotation model in his 1996 book Sector Investing. This model has articulated a de facto standard for sector analysis and sector-rotation decisions throughout a business cycle. It isn’t intended to be a granular forecasting method for the markets, however, the general implications that come from this model seem relevant right now.

When Energy and Basic Materials sectors are the leading performers, according to Stovall’s model, it coincides with a period that investors will likely look back on as a market top.

Some critics would argue that this model is, nowadays, a self-fulfilling prophecy. Professional money managers using this model might be taking actions that follow this model simply because they believe it is a market top. If they sell enough tech stocks while rotating to these other sectors, the rest of the market may follow, creating a negative feedback loop that portends a bear market.

Proponents would say those two sectors are driven by inflation and currency weakness which inevitably leads to reduced profits on balance sheets and reduced returns to investors. These different viewpoints still have the same outcome. If you are depending on bullish market to help you grow your retirement funds, then you’ll want to hope that Mr. Stovall was simply wrong.

Gordon Scott, CMT is a former managing director of the CMT Association and a current member of the Investopedia Financial Review board. He has over 20 years of experience as a coach and trader in securities, futures, forex, and penny stocks. He is a co-founder of Edge Finder. Learn more at https://myedgefinder.com/.

Shared content and posted charts are intended to be used for informational and educational purposes only. CMT Association does not offer, and this information shall not be understood or construed as, financial advice or investment recommendations. The information provided is not a substitute for advice from an investment professional. CMT Association does not accept liability for any financial loss or damage our audience may incur.