- Investopedia is partnering with CMT Association on this newsletter

- The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice

- The guest […]

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

Here comes another week where the word UNCERTAINTY will be front and center.Traders will continue to watch headlines around the legitimacy and implications when it comes to tariffs, the geo-political tensions between the U.S. and China as well as an escalation of war by Russia towards Ukraine.There will also be some certain factors. A speech by Jerome Powell on Monday plus lots of hard data to sift through, especially regarding the labor market. However, again, it’s the unpredictability out of Washington that may cause the most volatility.

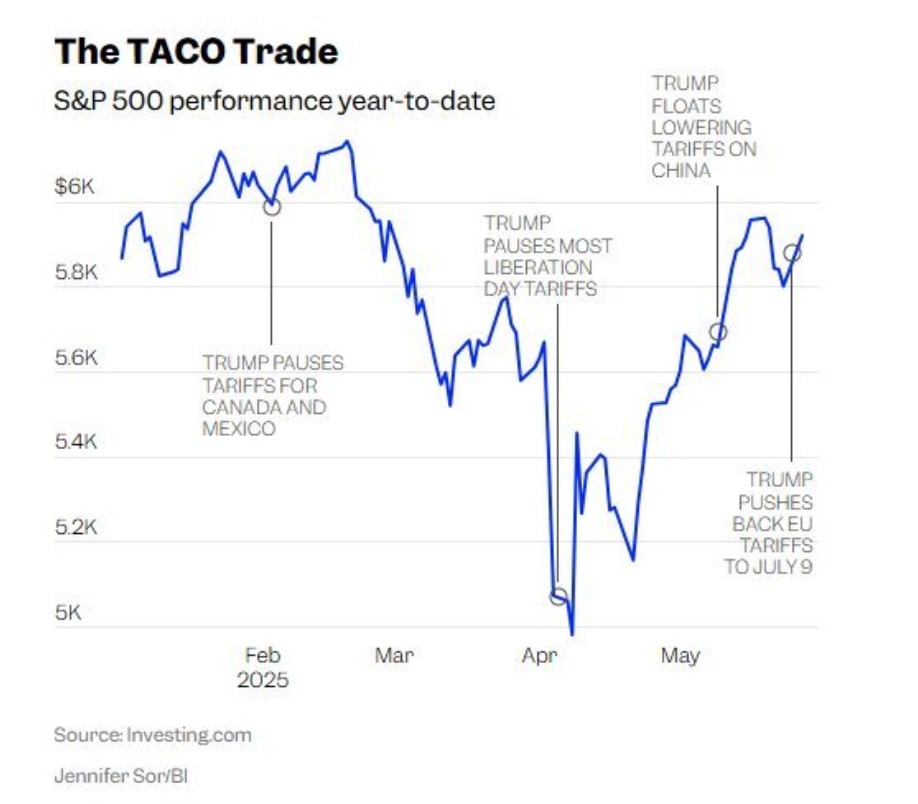

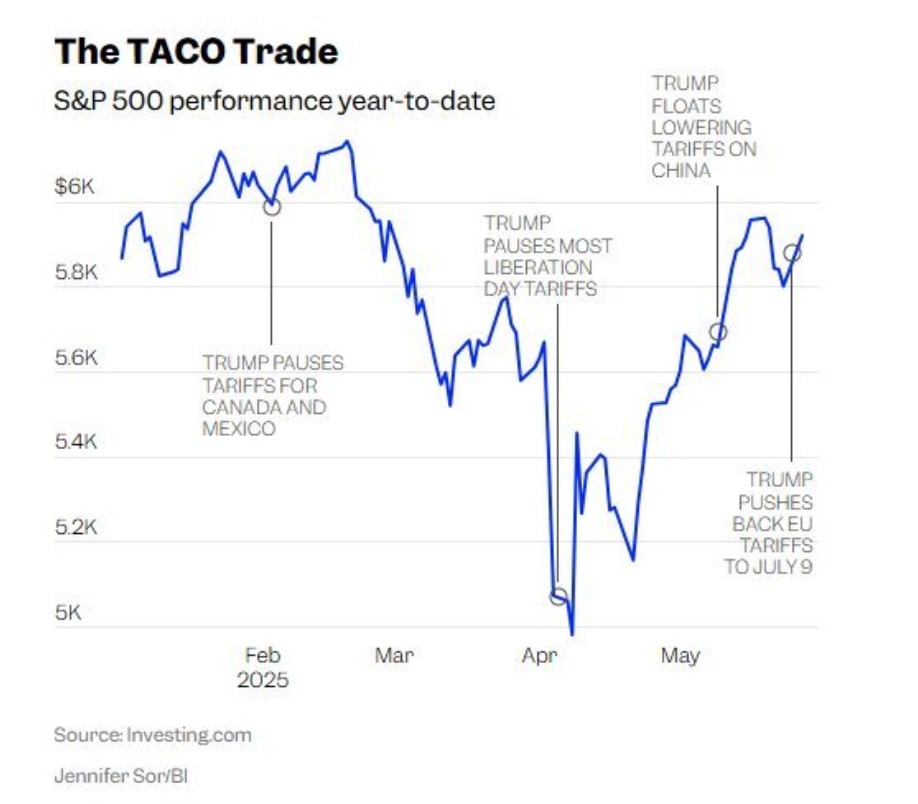

TACO Fall-out? Once again the market rallied after the threat of tariffs was delayed and reduced. This time there was an announced delay on 50% tariffs directed towards the European Union. This most recent decision to delay tariffs led to the Financial Times coining the term the “TACO trade” – Trump Always Chickens Out.It refers to the continued pattern of tariff threats that cause the market to sell-off and then eventually rally as the threat is walked back. You can see the direct market impact in the chart below.

This new acronym did not seem to sit well with the President. It may sound silly, but it could have repercussions. Add in the fact that the courts have pushed back against his tariffs and this should further encourage him to fight back. So far, outside of a potential and confusing deal with Britain, there have been no deals – just the potential of “many great deals” that may occur “within two weeks”. In an environment of continued uncertainty this new TACO wrinkle may muddy the waters even more. We have seen how the market reacts to that rhetoric. The potential for more of that bluster is higher than ever. If Trump pushes back to show strength or that he is not a “chicken”, the market could retreat. For now, we continue to be at the whim of Washington. Trying to predict what President Trump may do or say next has been a fool’s game. Will the chicken out comment draw his ire having implications causing increased volatility for a market looking for certainty, or is the TACO comment a misnomer and just part of his negotiating tactics? We will likely find out throughout the week.

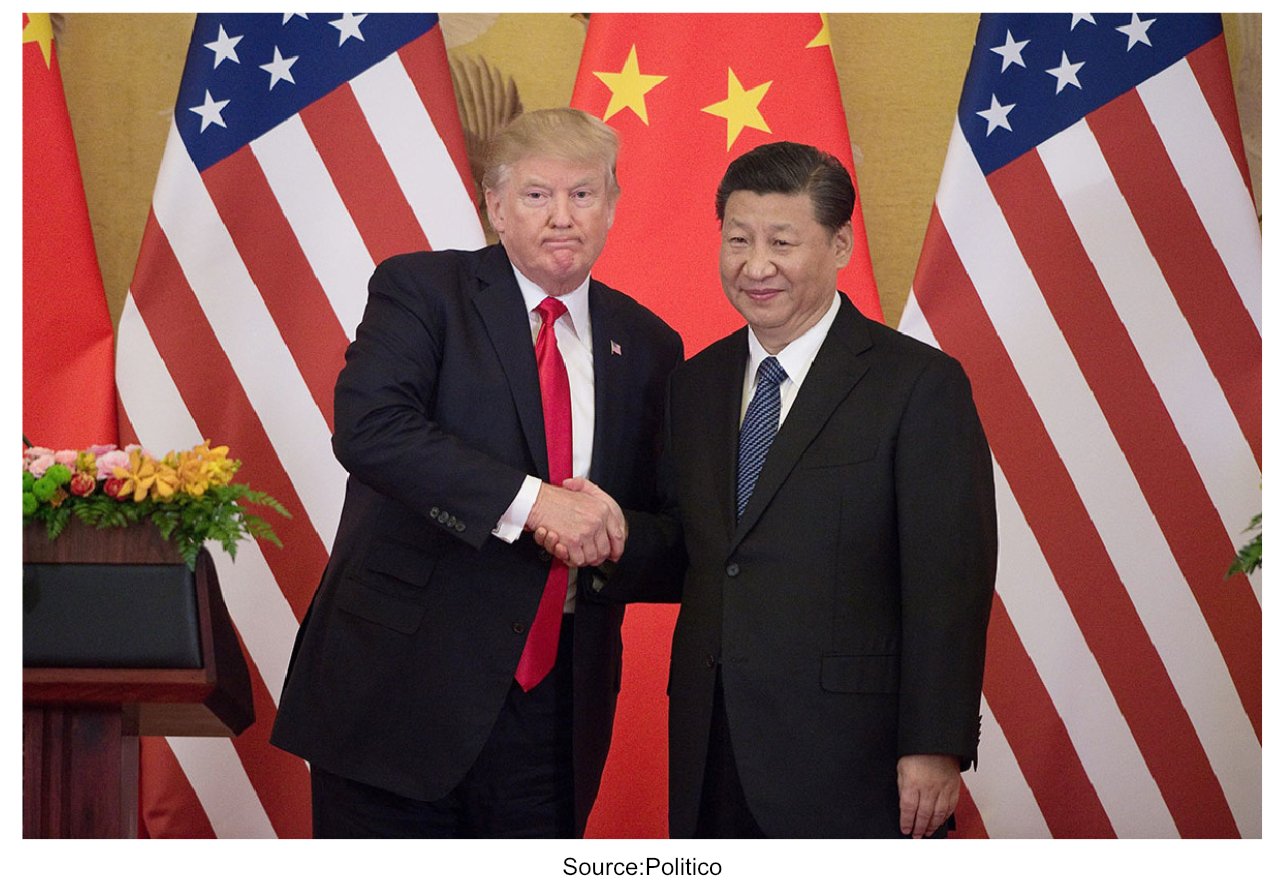

China Concerns. The Secretary of the Treasury, Scott Bessent, said China talks have hit a snag and that President Trump will need to talk to President Xi. On Friday, Trump said in a press conference with Elon Musk that he “believes they will talk”.Then the President took to Truth Social and didn’t assuage fears that things were getting better. He noted that China “HAS TOTALLY VIOLATED ITS AGREEMENT WITH US. So much for being Mr. NICE GUY!”

Later on Friday, U.S. Defense Secretary Pete Hegseth issued a stern warning about China’s military preparations. He stated that an invasion of Taiwan is “real and could be imminent.” He emphasized the need for regional allies to bolster their defenses.Conversations between Trump and Xi could prove critical to much needed clarity for the largest economies in the world. If they get clarity, look for another leg higher in this market and talk of new all-time highs. If this back-and-forth goes on, then expect volatile markets to continue.

Powell Speech. On Monday Fed Chairman Jerome Powell is scheduled to speak at 1:00PM in Washington DC at a research conference. This will mark his first public comments following a meeting with President Trump last week.The discussion is anticipated to address the administration’s push for lower interest rates amidst ongoing tariff implementations. Investors will be keenly observing any indications of shifts in monetary policy.Overall, expect nothing new to come from this speech but it will be covered and dissected abundantly.

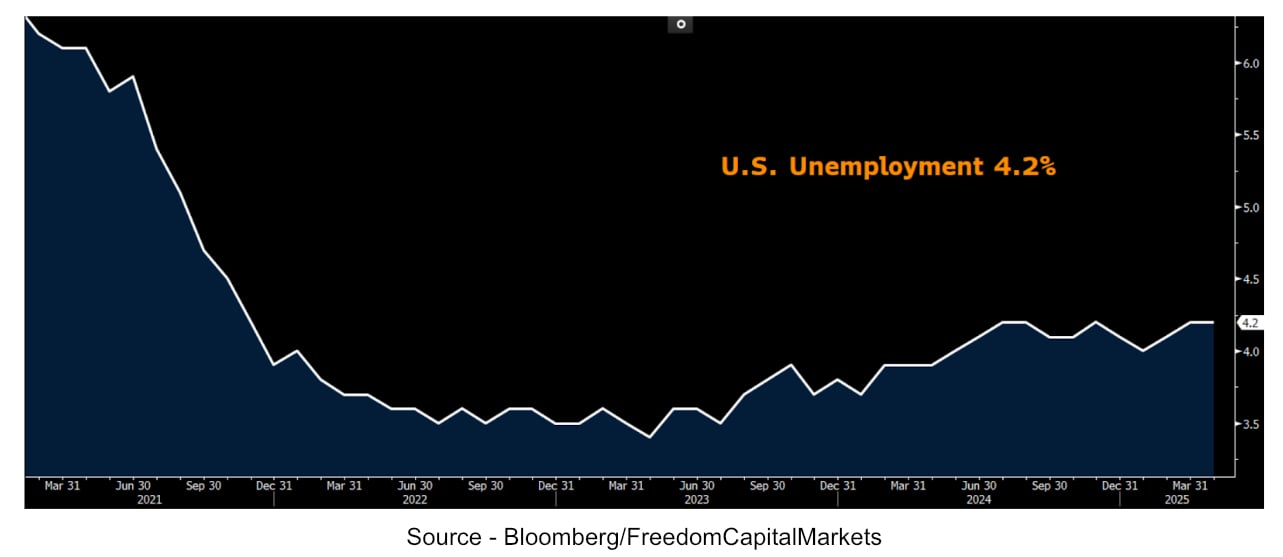

Unemployment. On Friday we get a look at May unemployment data that is predicted to remain stable at 4.2%. Despite a high level of uncertainty and sentiment that reached record low levels, the justification of this fear has yet to be seen in the hard data.

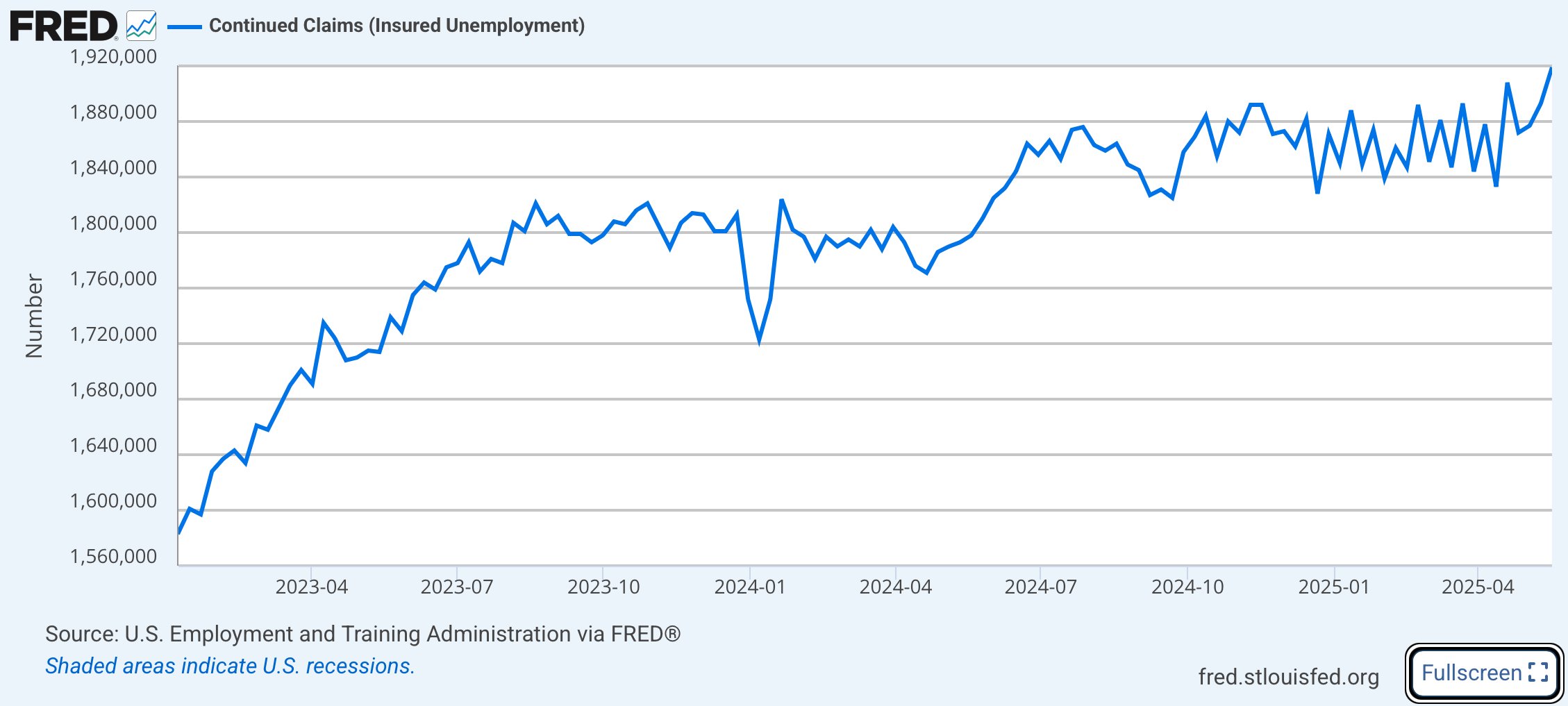

What may be more important, barring any major surprises, is Thursday’s weekly jobless claims.Last week U.S. initial jobless claims stood at 240,000, an increase of 14,000 from the previous week. The last time initial jobless claims exceeded 250,000 was in October 2024, when they rose to 258,000. This spike was primarily attributed to disruptions caused by Hurricane Helene and a strike by Boeing machinists.Prior to the spike in October 2024, the last time U.S. initial jobless claims exceeded 250,000 was in late July 2024. Again, this increase was attributed to temporary factors such as motor vehicle plant shutdowns and disruptions caused by Hurricane Beryl in Texas.Since then, weekly claims have generally remained below the 250,000 threshold, reflecting a relatively stable labor market. However, given a steady rise in continuing claims – the longer it takes those out of work to find a job – a rise over 250,000 without any extenuating circumstances like in its prior instances could cause a downdraft in the market.

Speaking of those continuing claims, as seen in the chart above, they just reached their highest level since 2021 and spiked out of a range that had been quite stable for close to two years.

Continue Reading on Freedom Capital Markets…

Shared content and posted charts are intended to be used for informational and educational purposes only. CMT Association does not offer, and this information shall not be understood or construed as, financial advice or investment recommendations. The information provided is not a substitute for advice from an investment professional. CMT Association does not accept liability for any financial loss or damage our audience may incur.