Update

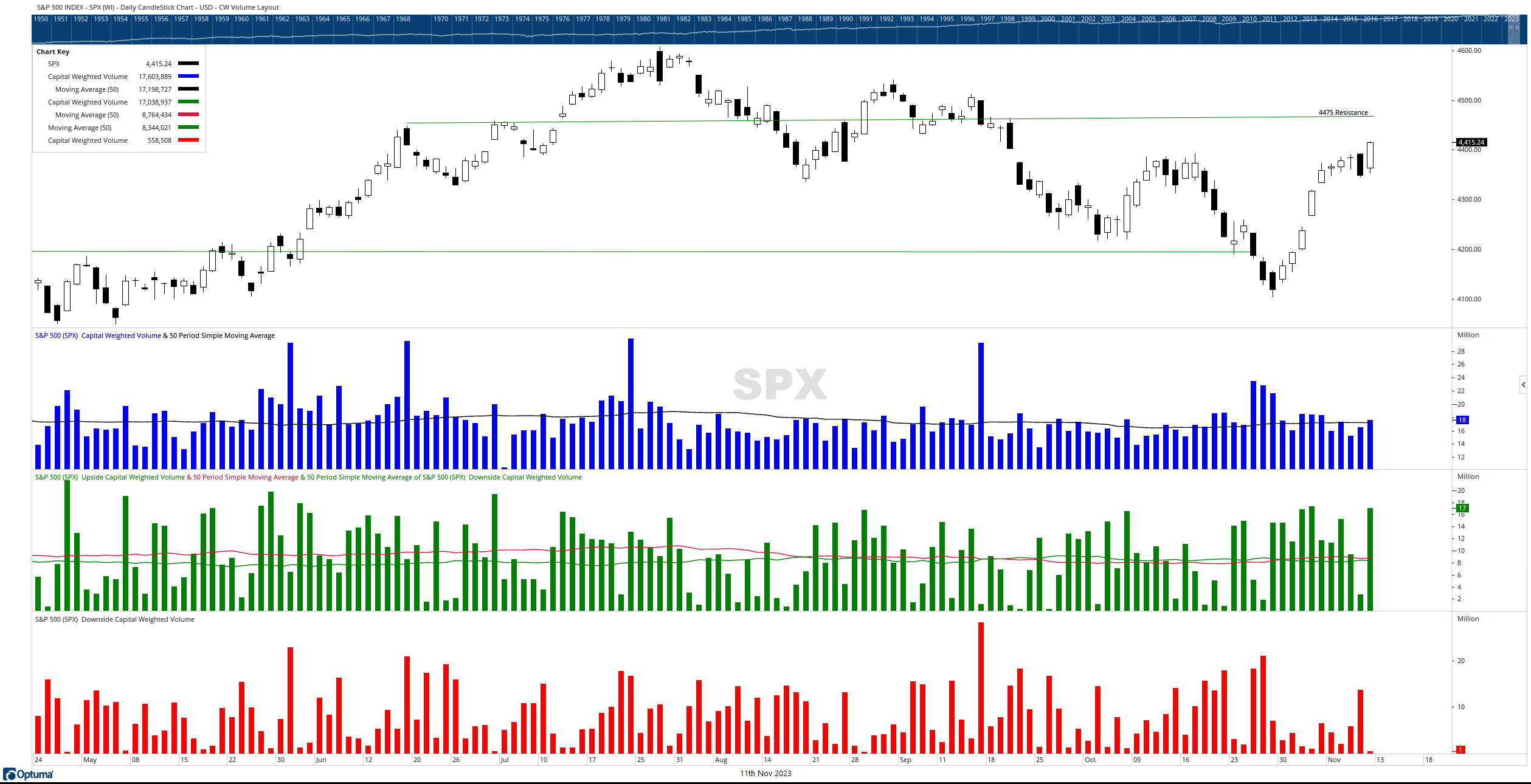

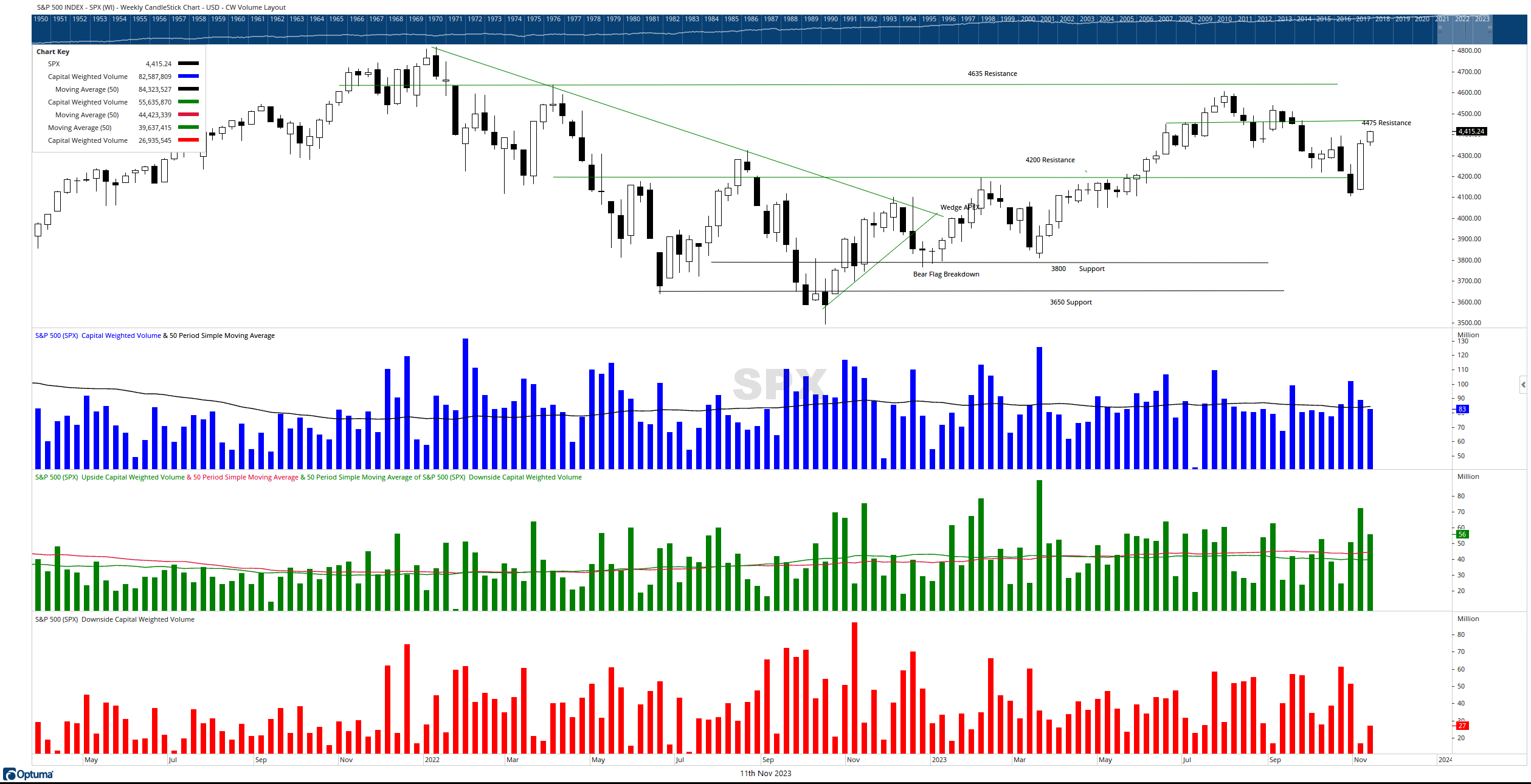

The Generals (NDX 100) once again led the markets, surging 2.85% higher for the week. Unfortunately, the troops (IWM Russell 2000 ETF) retreated by -3.08%, closing near the minor support level of 168. In terms of capital flow, inflows exceeded outflows with $55.6 billion coming in compared to just under $27 billion going out. Consequently, more than twice as much money flowed into the S&P 500 than out, resulting in a 1.31% gain for the week.

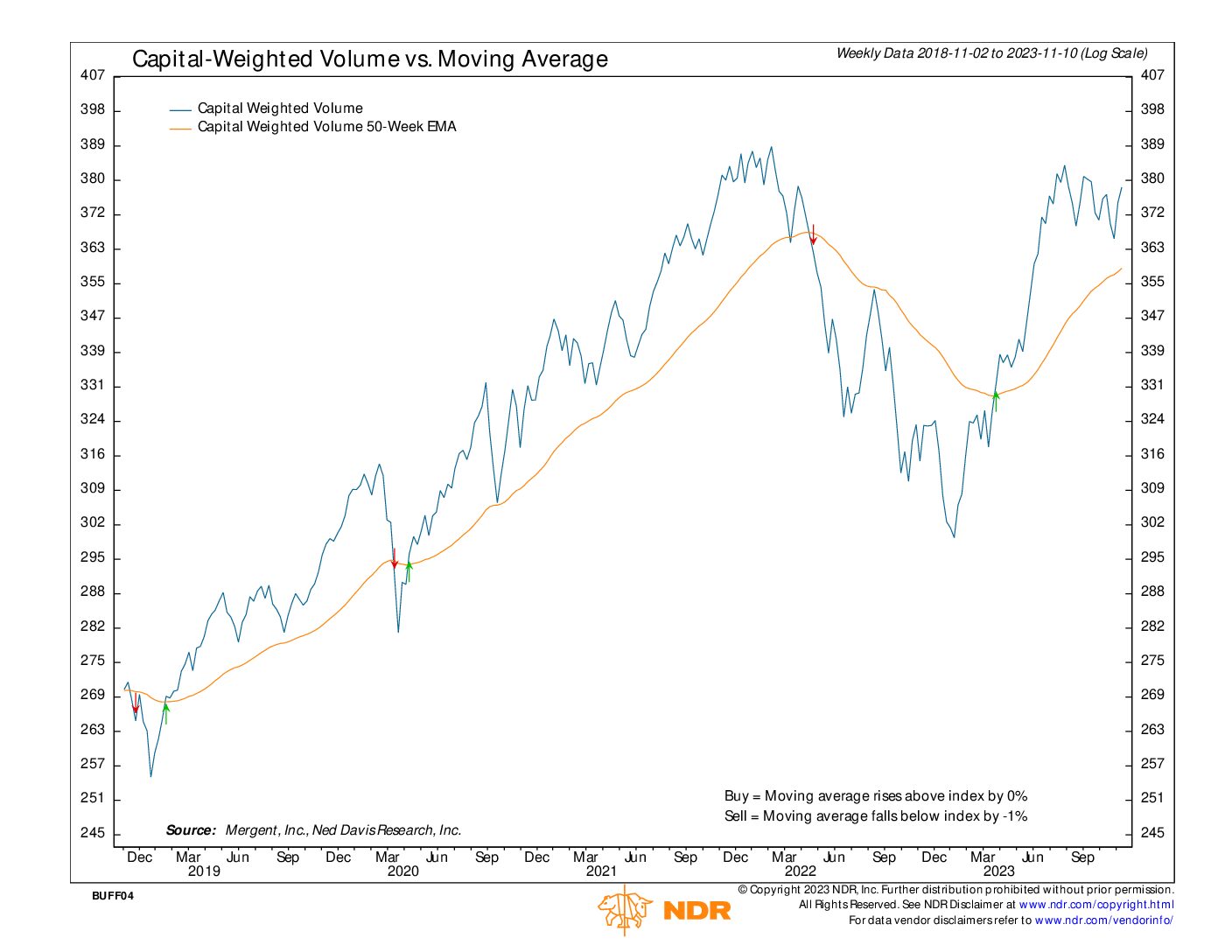

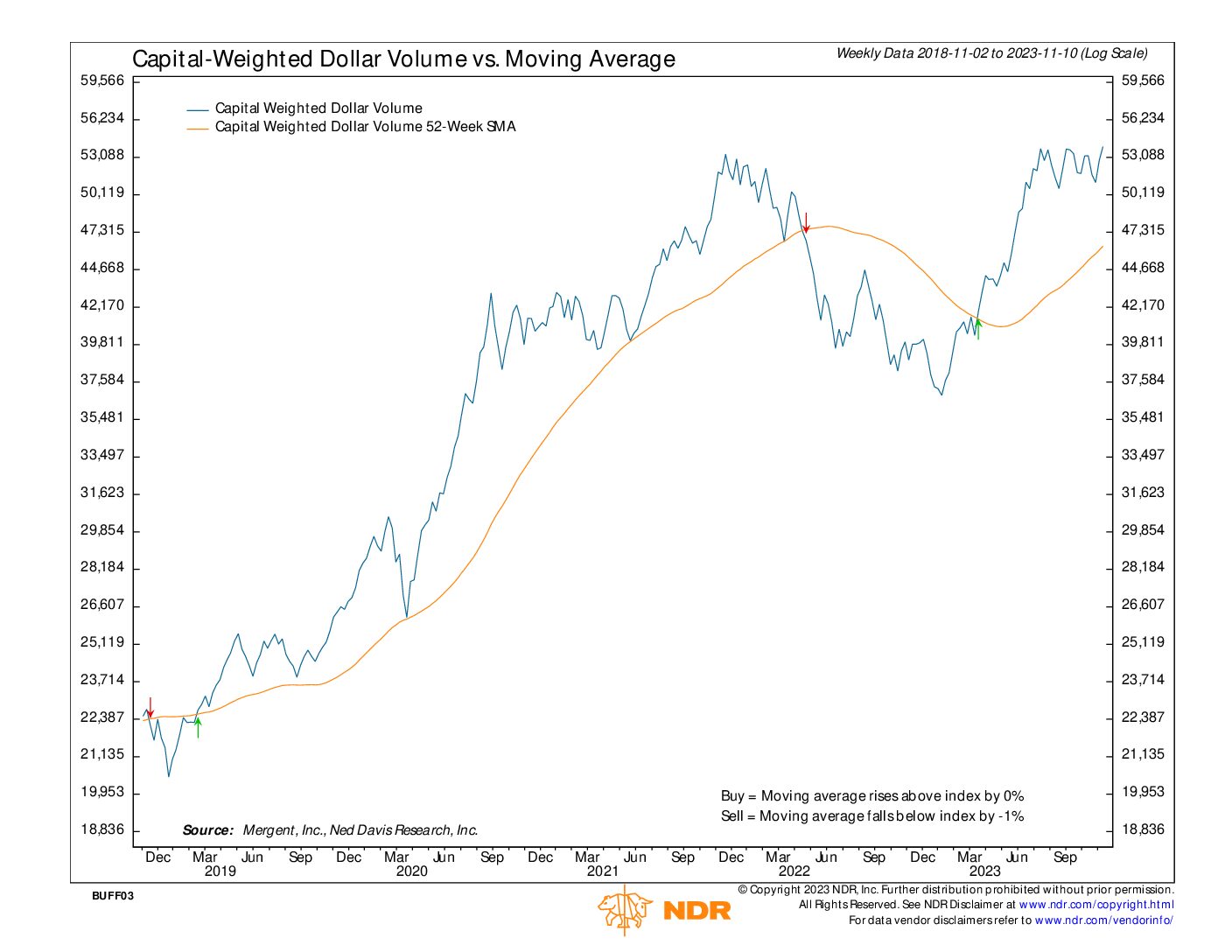

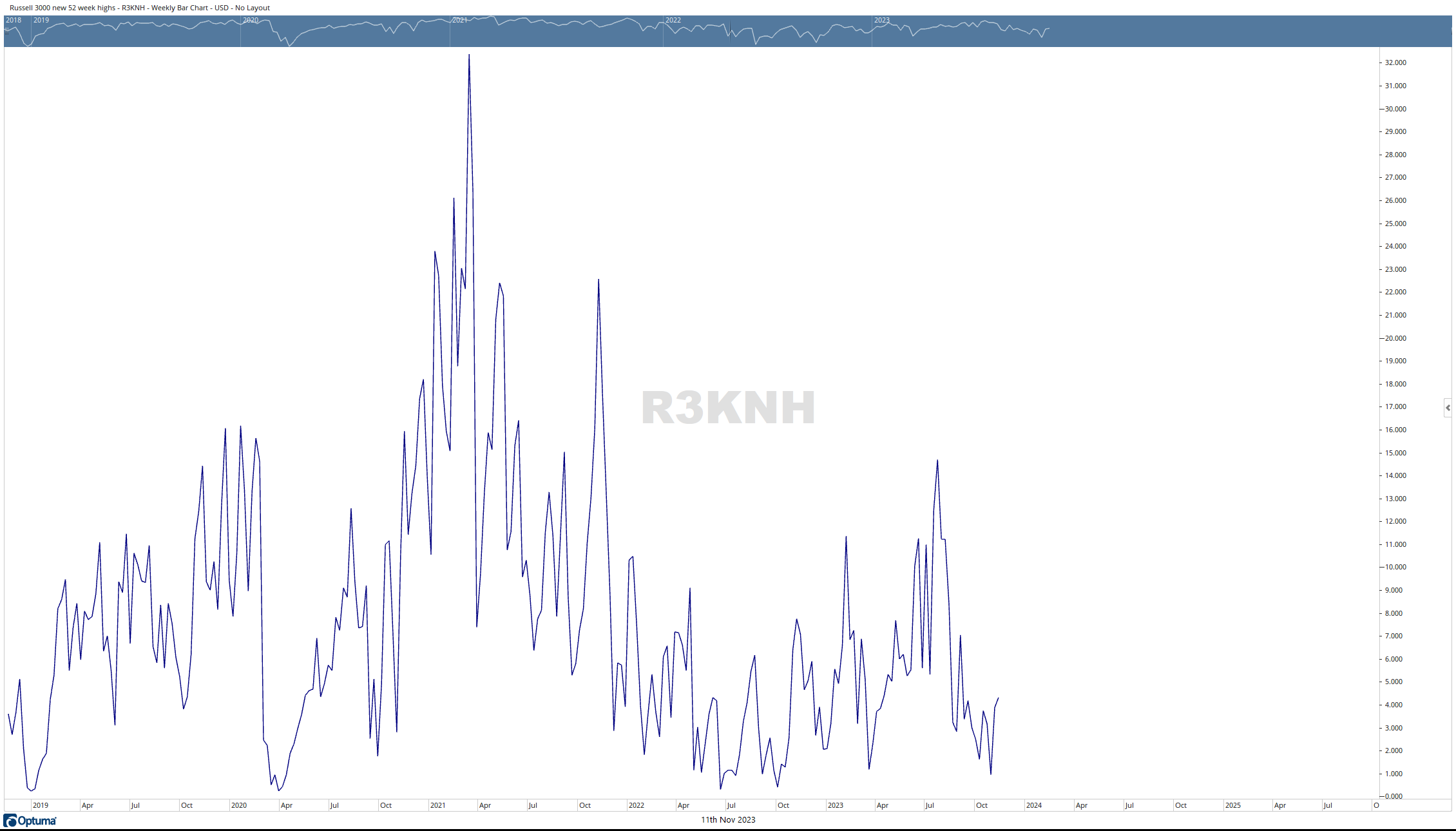

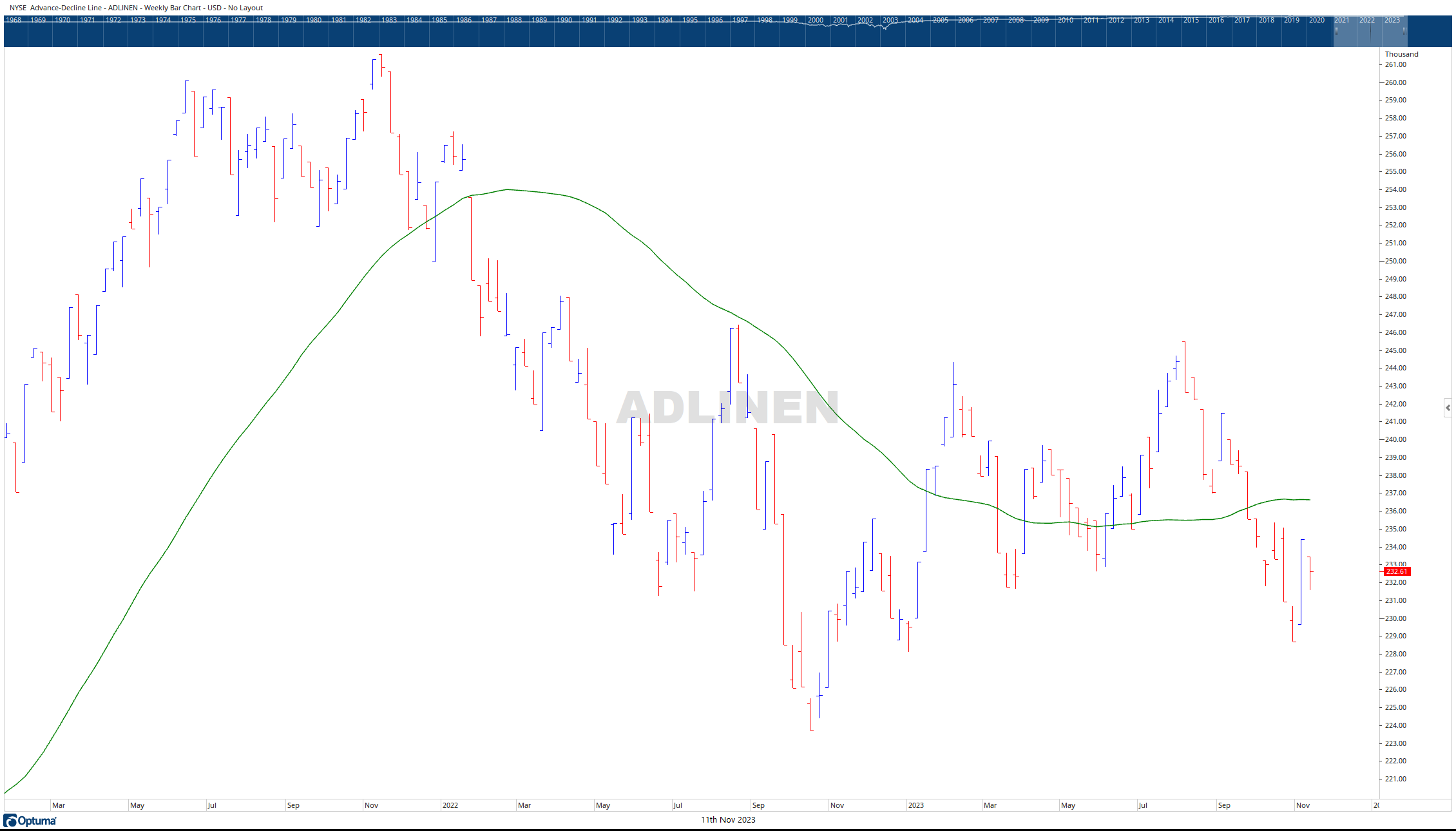

Perhaps the most significant development this week was Capital Weighted Dollar Volume reaching a new all-time high. Although just inching slightly above, this achievement is noteworthy, especially considering that the S&P 500 is still below its June and July yearly highs and well off its all-time highs. From a market breadth perspective, the number of stocks making new 52-week highs increased. However, the NYSE Advance-Decline Line closed the week lower but remained engulfed within the range established the previous week.

In summary, the strong volume thrust previously noted on 11/6 propelled the Generals (NDX) to higher levels, although the troops still lost momentum. The S&P 500 now has minor support at 4300 and major support at 4200. To regain a bullish outlook, the troops (IWM) must maintain levels above 163 neutral levels and break above 200 to join in on the general’s party. A healthy market demands broader participation beyond just the major leaders, yet the new all-time highs in Capital Weighted Dollar Volume may be a positive sign.

Shared content and posted charts are intended to be used for informational and educational purposes only. CMT Association does not offer, and this information shall not be understood or construed as, financial advice or investment recommendations. The information provided is not a substitute for advice from an investment professional. CMT Association does not accept liability for any financial loss or damage our audience may incur.