Update

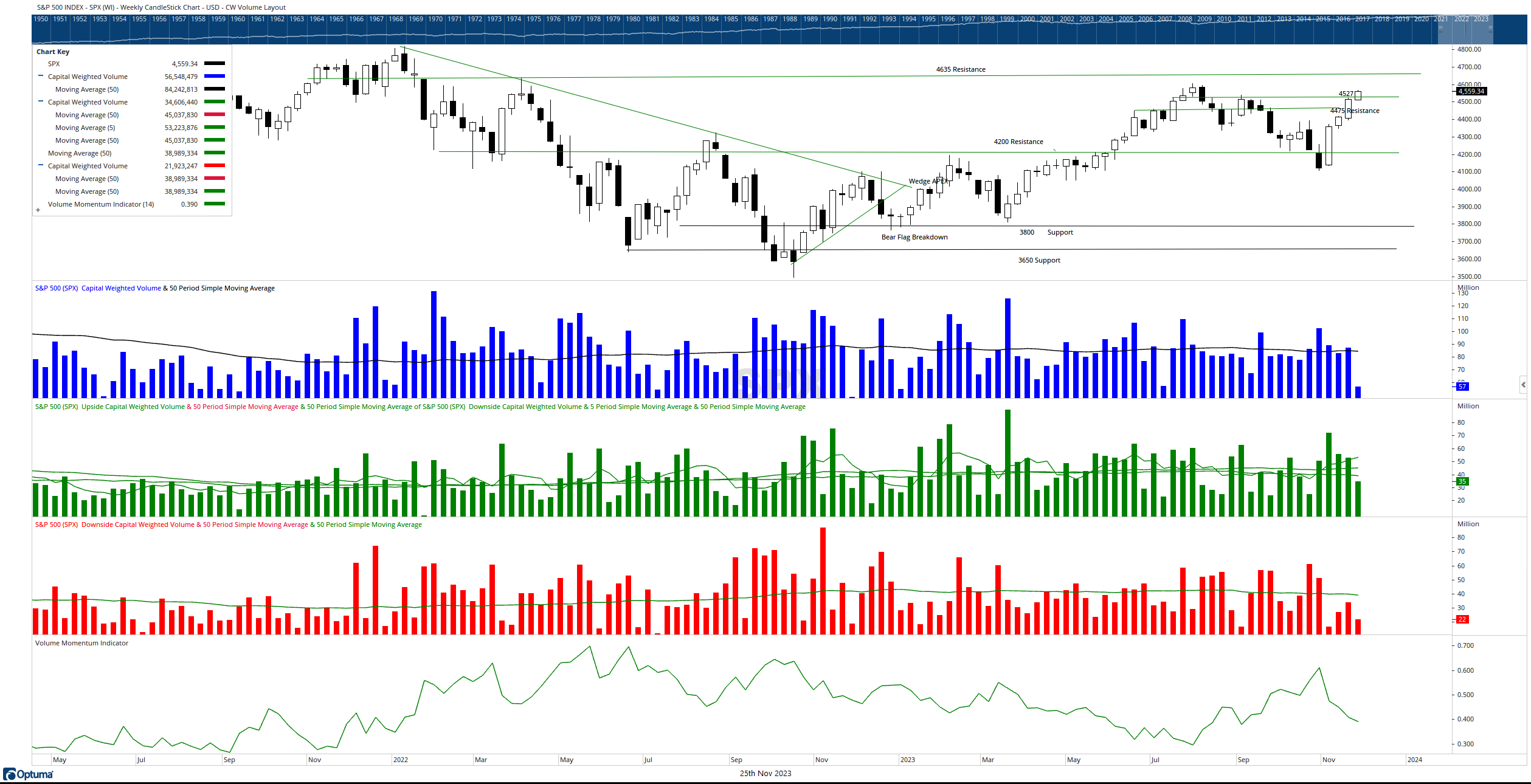

Volume was notably subdued last week, which aligns with expectations of a short trading week. The S&P 500 saw a robust influx of over $34.5 billion, contrasting sharply with just under $22 billion in outflows, culminating in a 1.00% S&P 500 price gain. However, the troops / small-cap stocks (IWM) and the heavy tech sector / mega cap index, the generals,(NDX), experienced more modest upticks of 0.58% and 0.91%, respectively, and emerged as the relative laggards in the week’s performance.

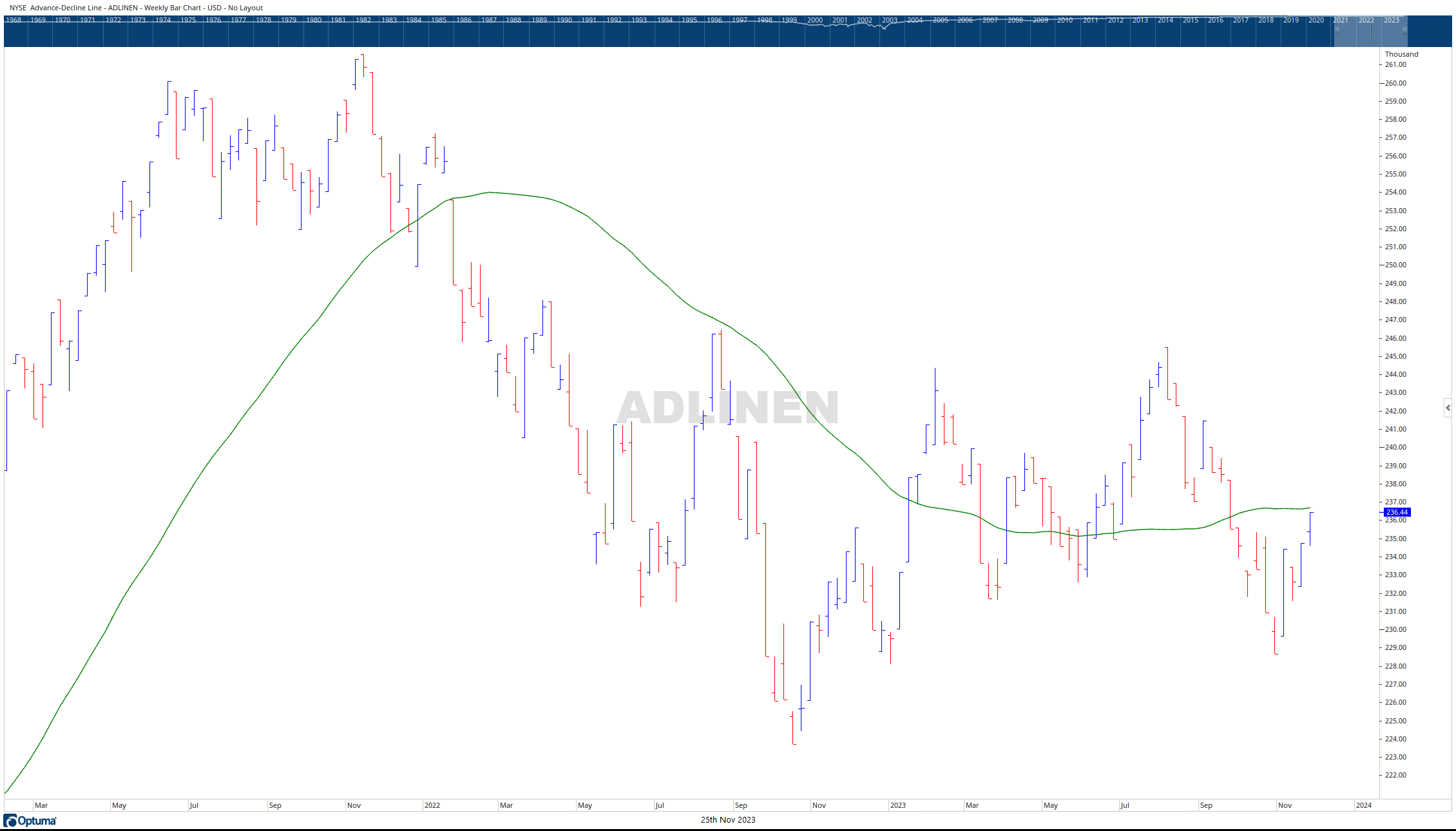

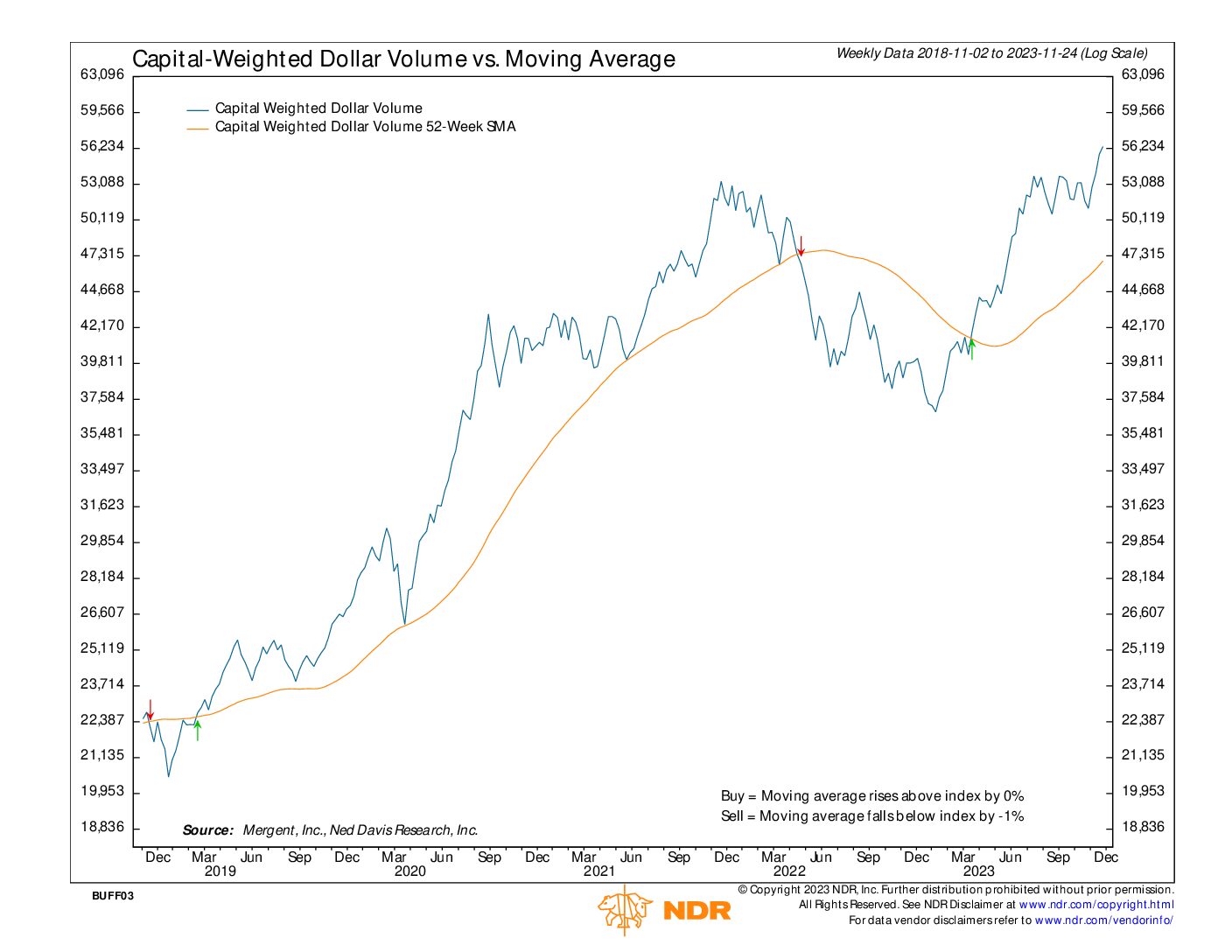

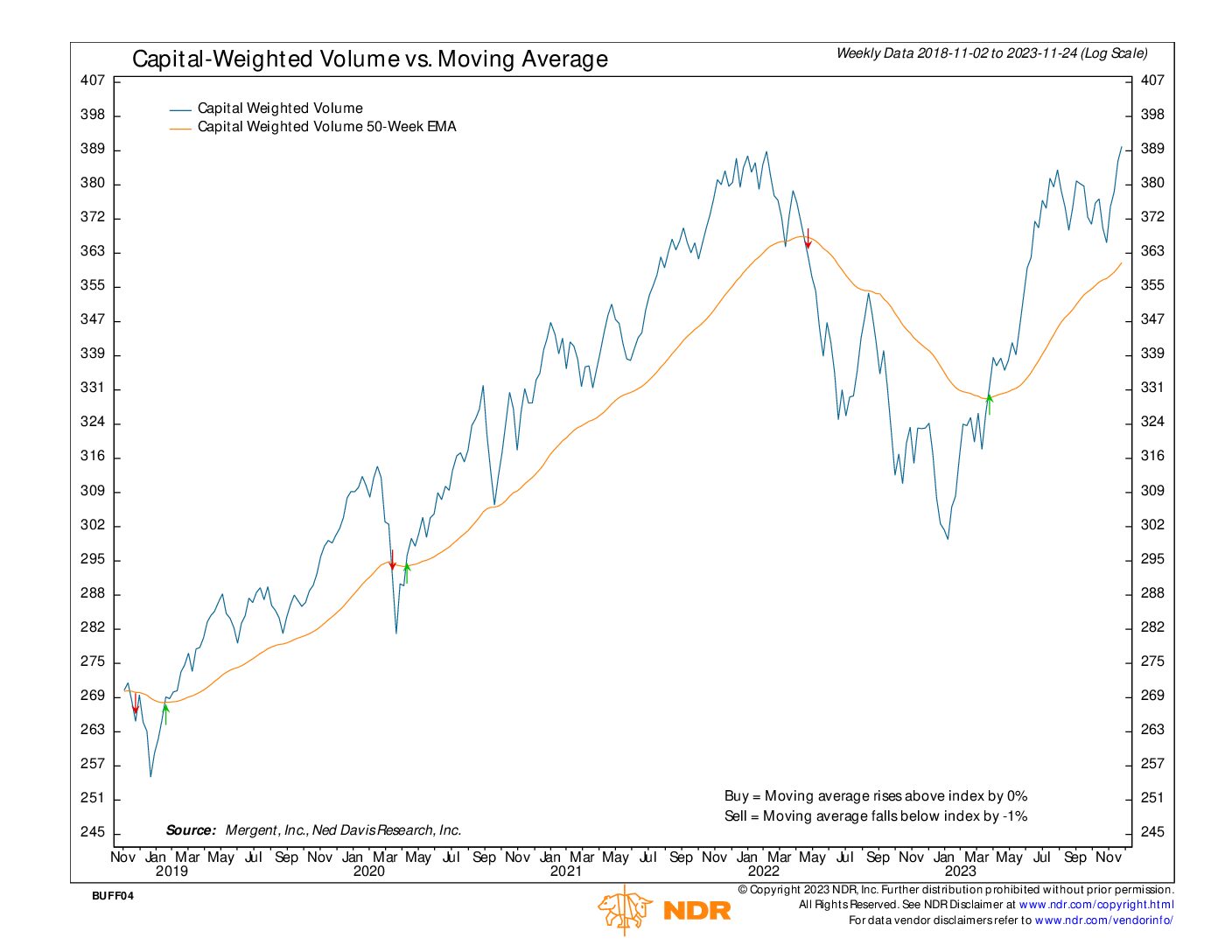

Positive momentum extended to market breadth, evident in the advancing Advance Decline Line, which is steadily approaching trendline resistance. Capital Weighted Dollar Volume achieved new all-time highs, and notably, Capital Weighted Volume is now on the verge of reaching historical peaks as well.

Looking ahead, minor SPX resistance is anticipated at the July highs of 4607, followed by more substantial resistance at 4635. The former S&P 500 resistance level of 4527 now acts as short-term support, while intermediate support is situated at 4475. The ongoing strength in Capital Weighted Volume and Dollar Volume demonstrates capital flows into the equity market appear to remain strong.

Shared content and posted charts are intended to be used for informational and educational purposes only. CMT Association does not offer, and this information shall not be understood or construed as, financial advice or investment recommendations. The information provided is not a substitute for advice from an investment professional. CMT Association does not accept liability for any financial loss or damage our audience may incur.