Volume Analysis | Flash Market Update

Published on 12/11/2023

December 11, 2023

Update

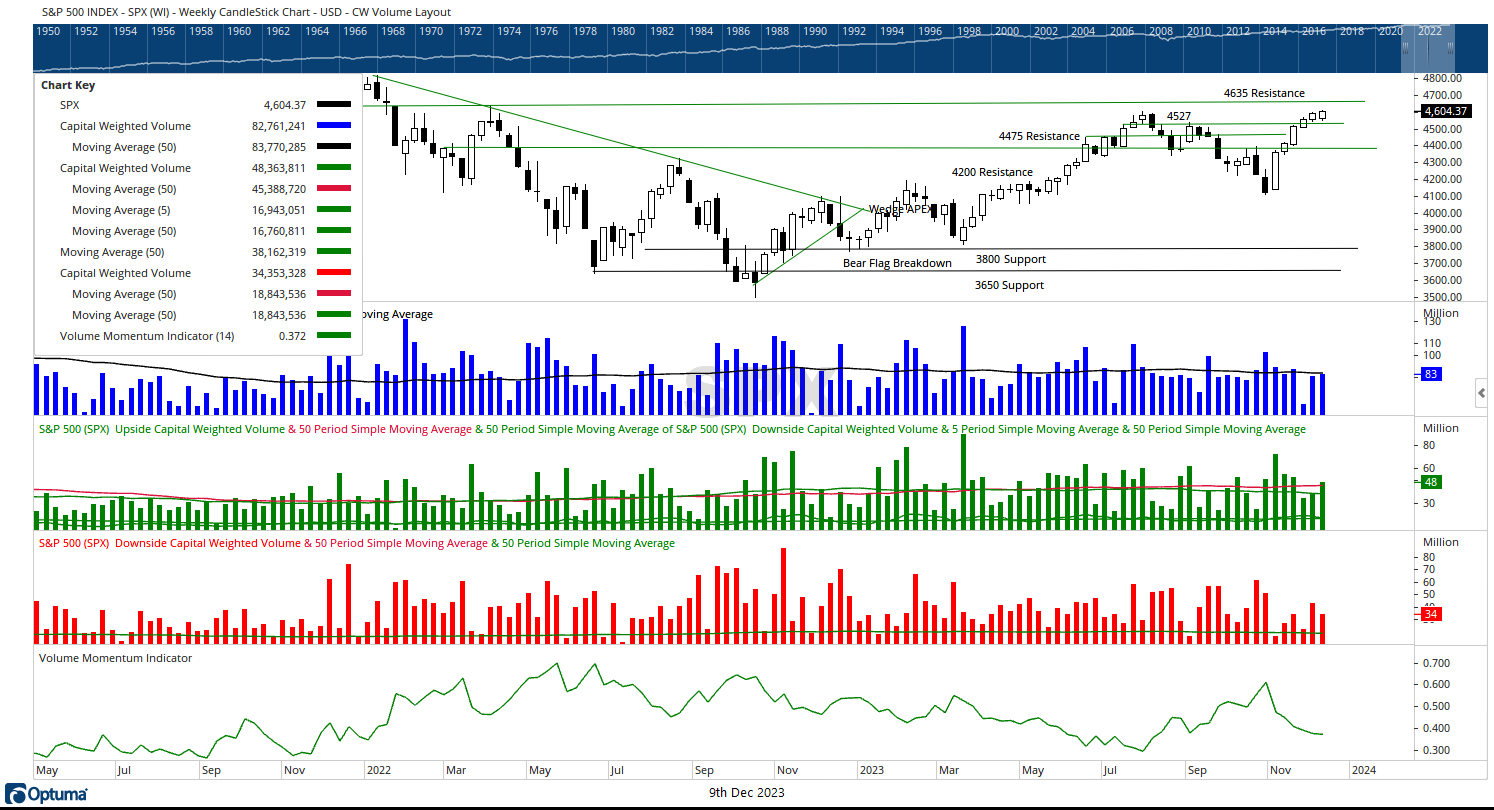

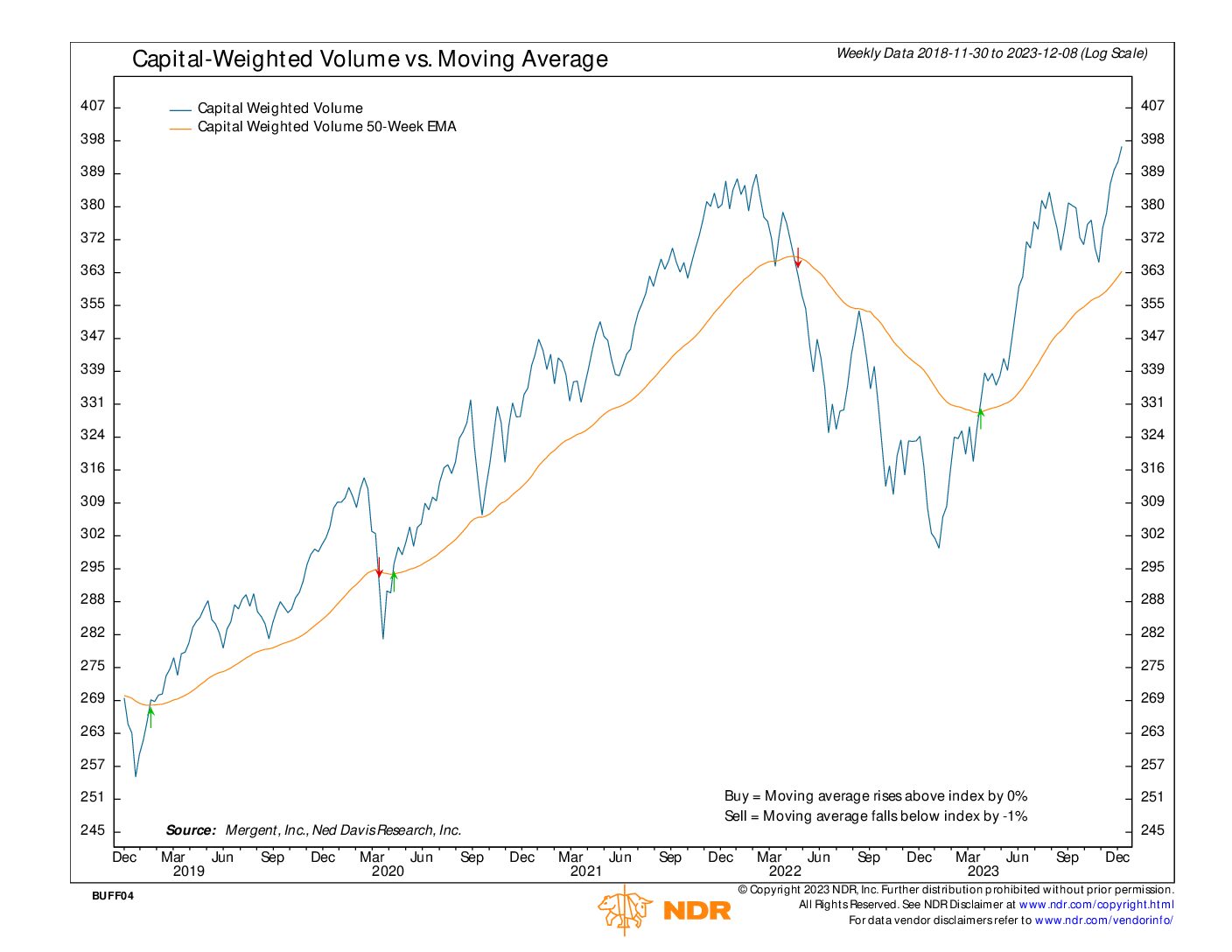

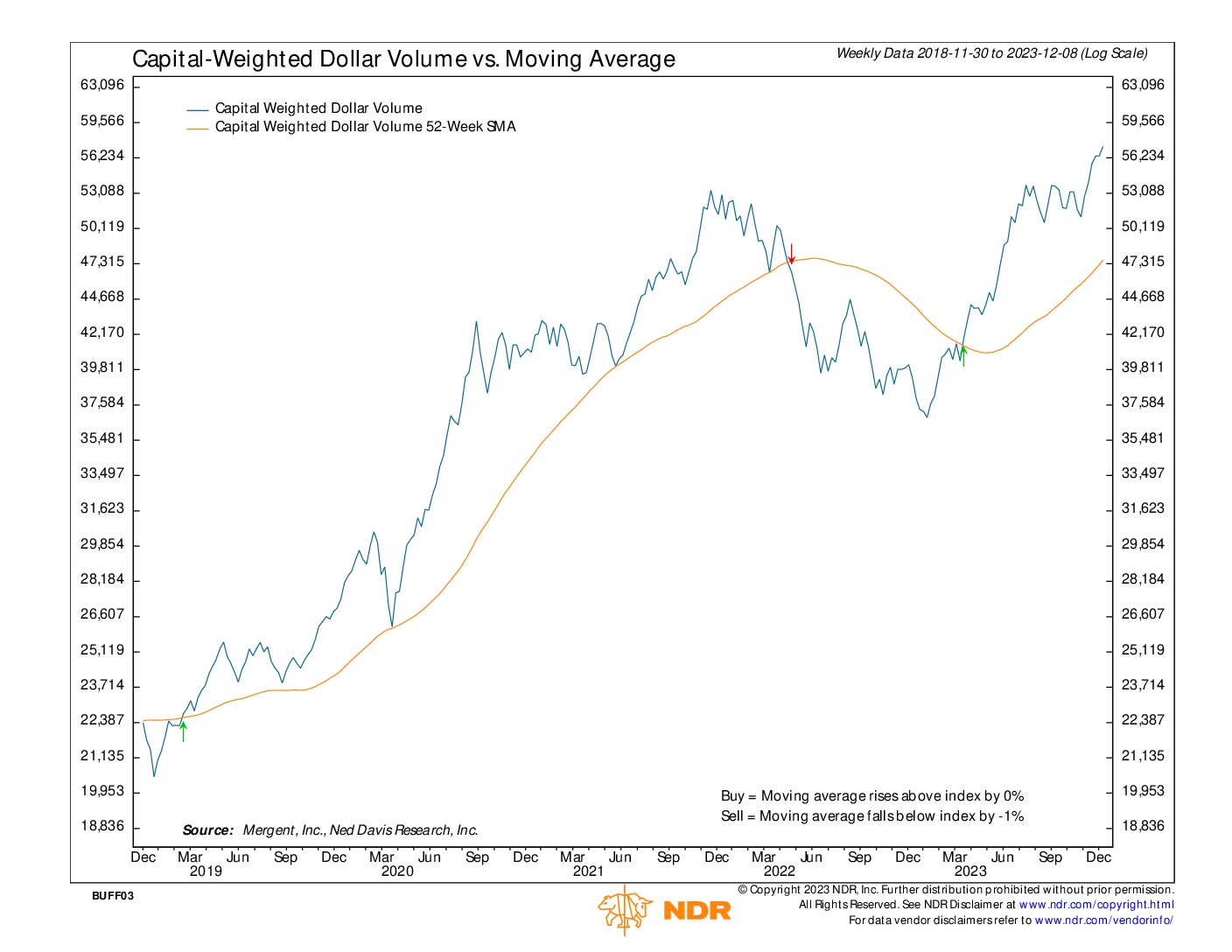

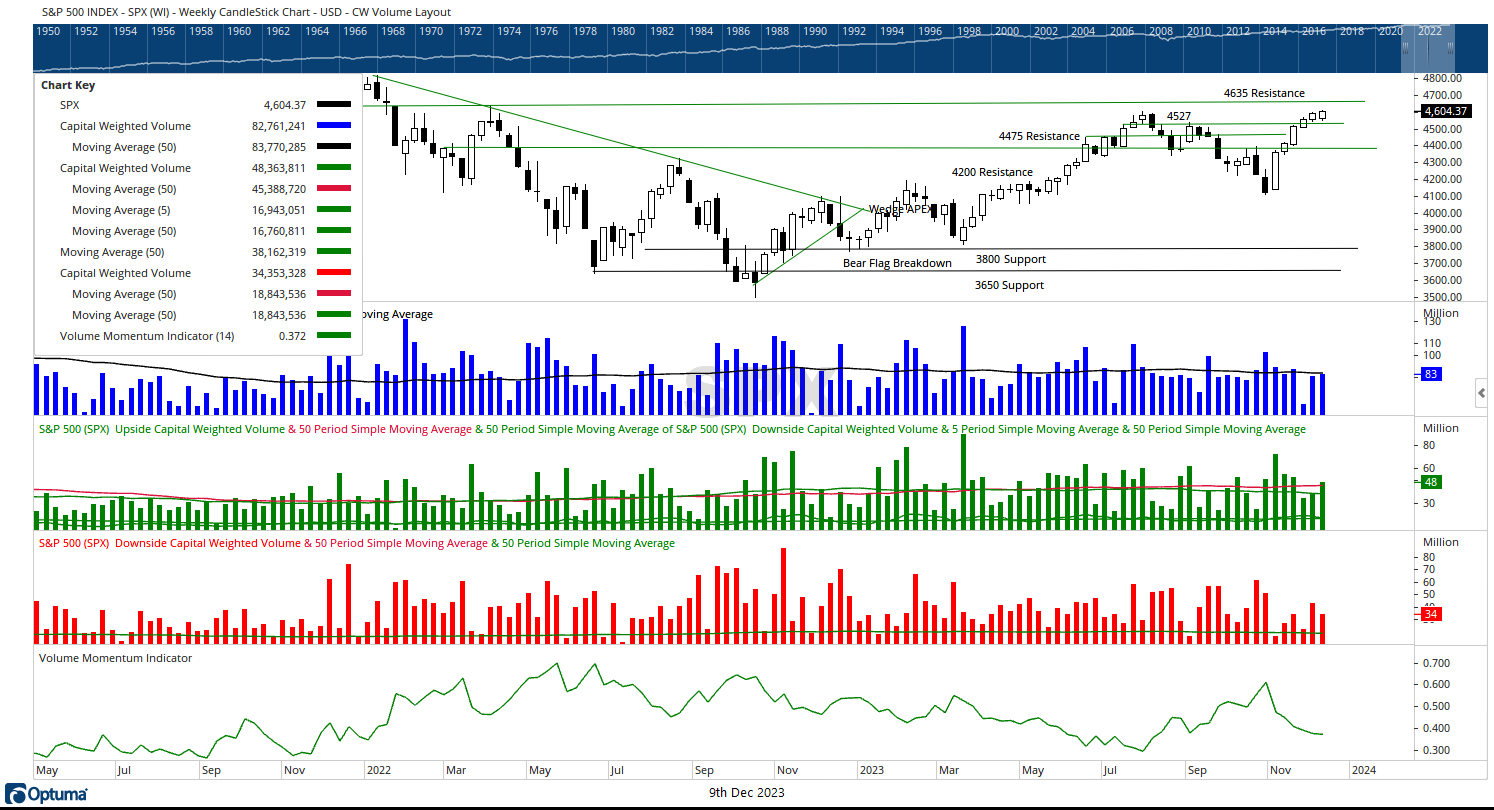

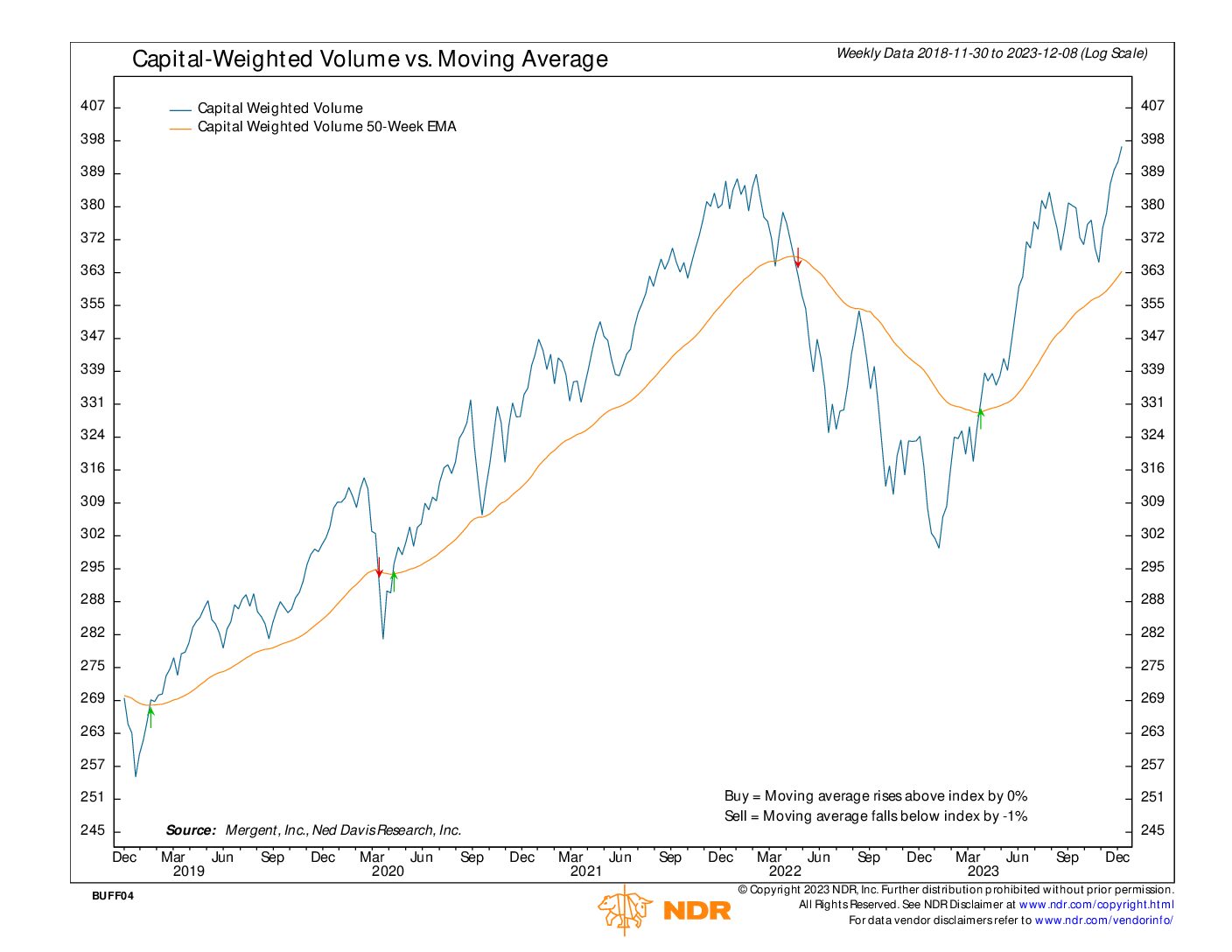

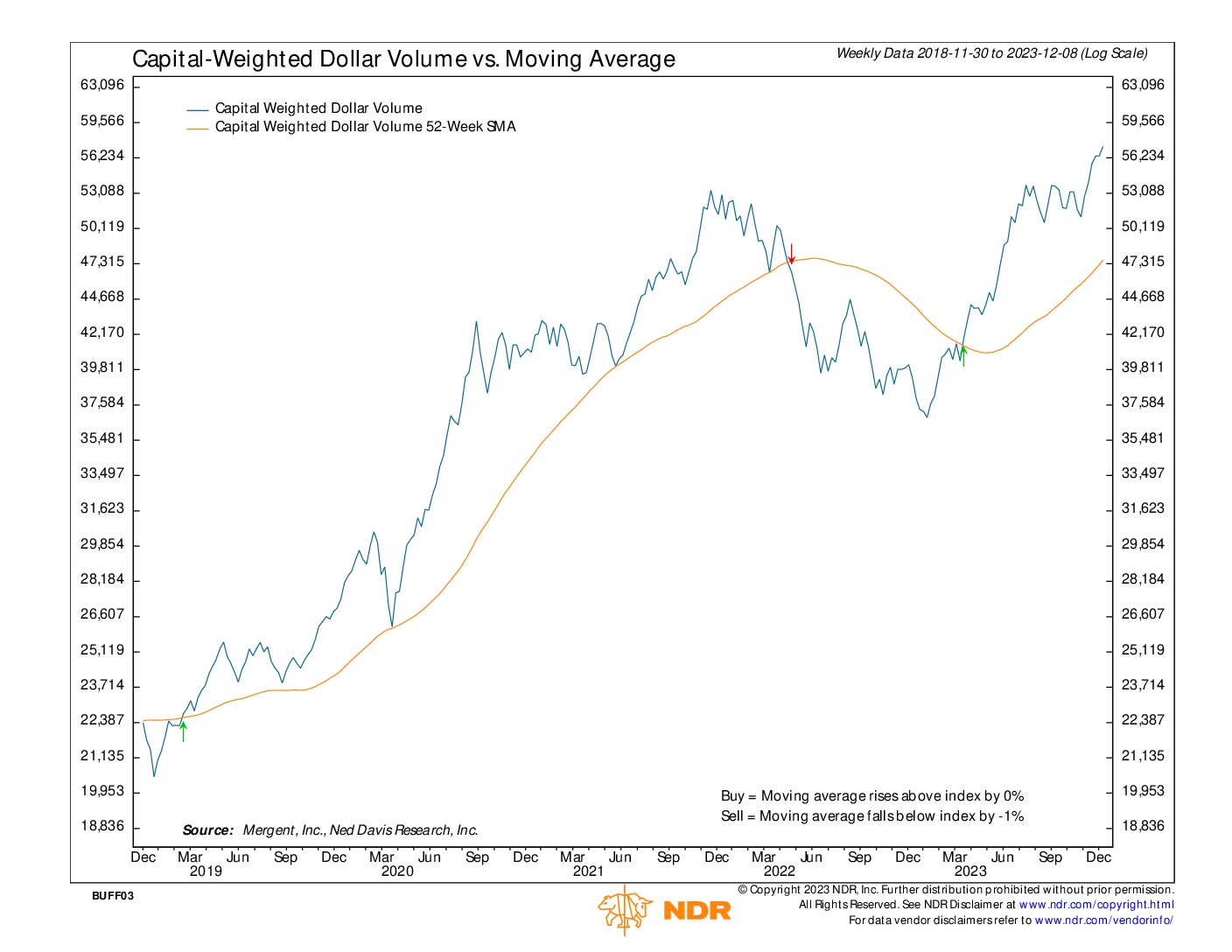

Although the S&P 500 concluded the week with a modest 0.14% gain, capital flows exhibited a more significant surge. Capital inflows came in at $48.3 billion compared to only $34.3 billion in outflows. Both Capital Weighted Dollar Volume and Capital Weighted Volume closed the week at new all-time highs.

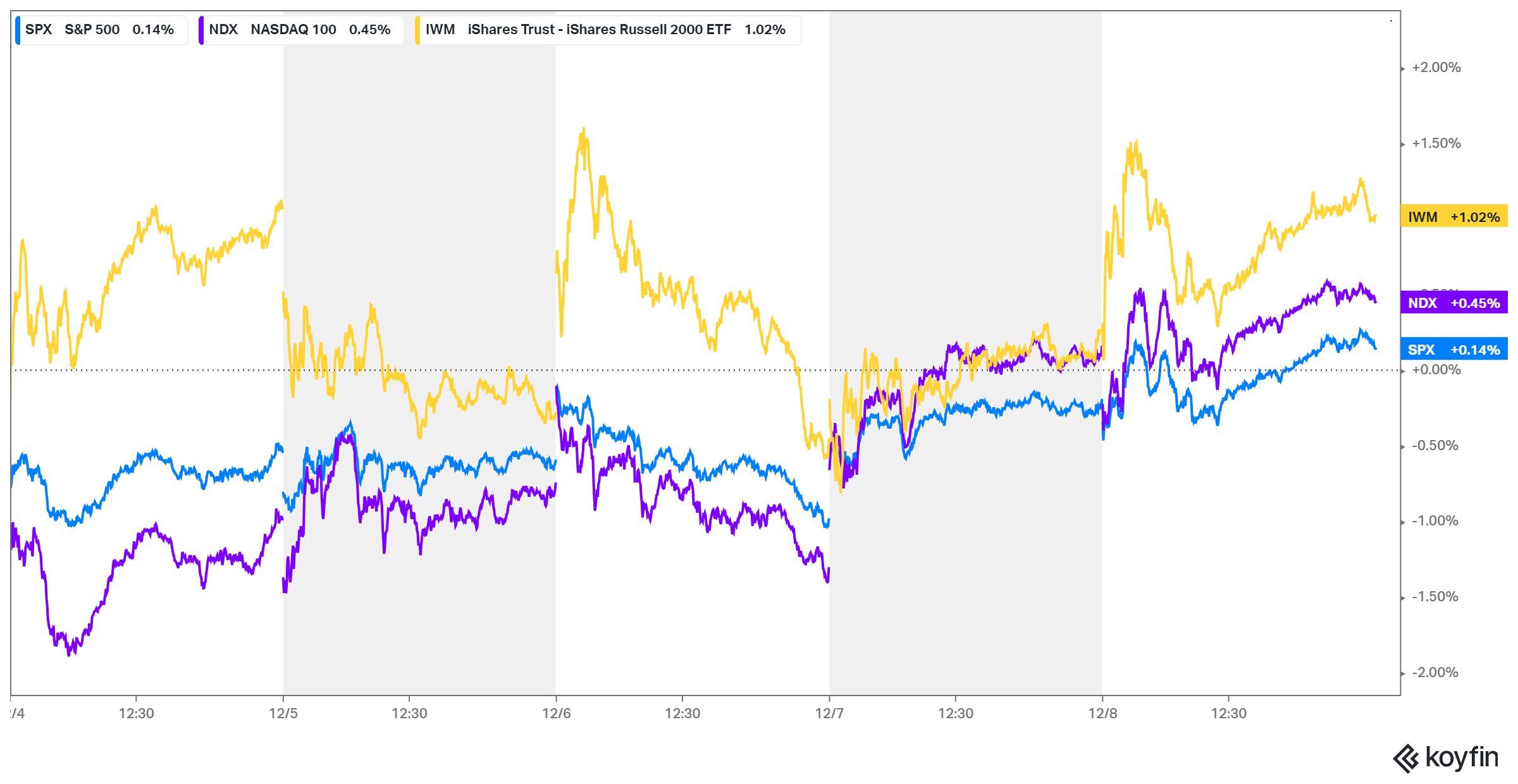

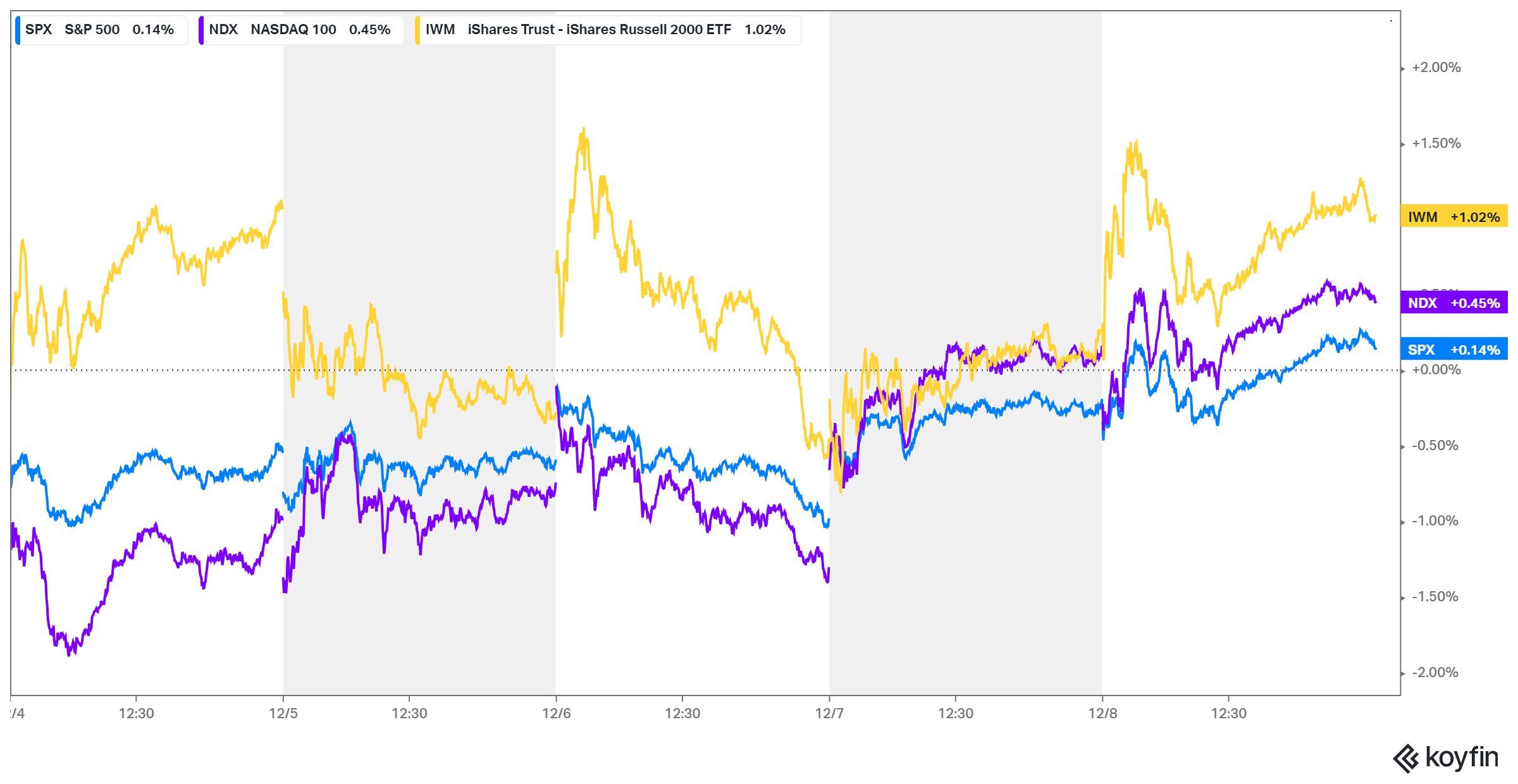

The Nasdaq 100, represented by the generals, and IWM, symbolizing the troops, delivered stronger performances. The NDX 100 experienced a 0.45% increase, while IWM (the iShares Russell 2000 ETF) surged forward by 1.02%.

Key levels for the S&P 500 include resistance at 4635 and minor support at 4527. Overall, the prevailing trend in capital flows continues to propel the markets higher as the markets broaden out, fostering a positive environment for bullish sentiments.

Shared content and posted charts are intended to be used for informational and educational purposes only. CMT Association does not offer, and this information shall not be understood or construed as, financial advice or investment recommendations. The information provided is not a substitute for advice from an investment professional. CMT Association does not accept liability for any financial loss or damage our audience may incur.

About the Author | Buff Dormeier, CMT

Buff Dormeier serves as the Chief Technical Analyst at Kingsview Wealth Management. Previously, he was a Managing Director of Investments and a Senior PIM Portfolio Manager at the Dormeier Wealth Management Group of Wells Fargo Advisors.

In 2007, Dormeier’s technical research was awarded the prestigious Charles H. Dow Award. Also an award winning author, Buff authored “Investing with Volume Analysis“. Partnering with Financial Times Press, Pearson Publishing and the Wharton School, this book is the only one to win both Technical Analyst’s Book of the Year (2013) and Trader Planet’s top Book Resource (2012) to date.

Buff’s work has also been featured in a variety of national and international publications and technical journals. Now, with Kingsview Wealth Management’s affiliation, Buff’s expertise and proprietary work on technical and volume analysis shall become much more accessible to journalists and other media alike.

As a portfolio manager, Buff was featured in “Technical Analysis and Behavior Finance in Fund Management” – an international book comprised of interviews with 21 PM’s across the world who utilize technical analysis as a portfolio driver. In his new role with Kingsview Wealth Management, Buff’s unique performance driven strategies will be now be available to a wide audience of financial advisors and institutional clientele.

Buff has a Bachelor’s Degree of Science (B.S.) in Business and a Bachelor of Applied Science (B.A.Sc.) in Urban and Regional Planning from Indiana State University.