Update

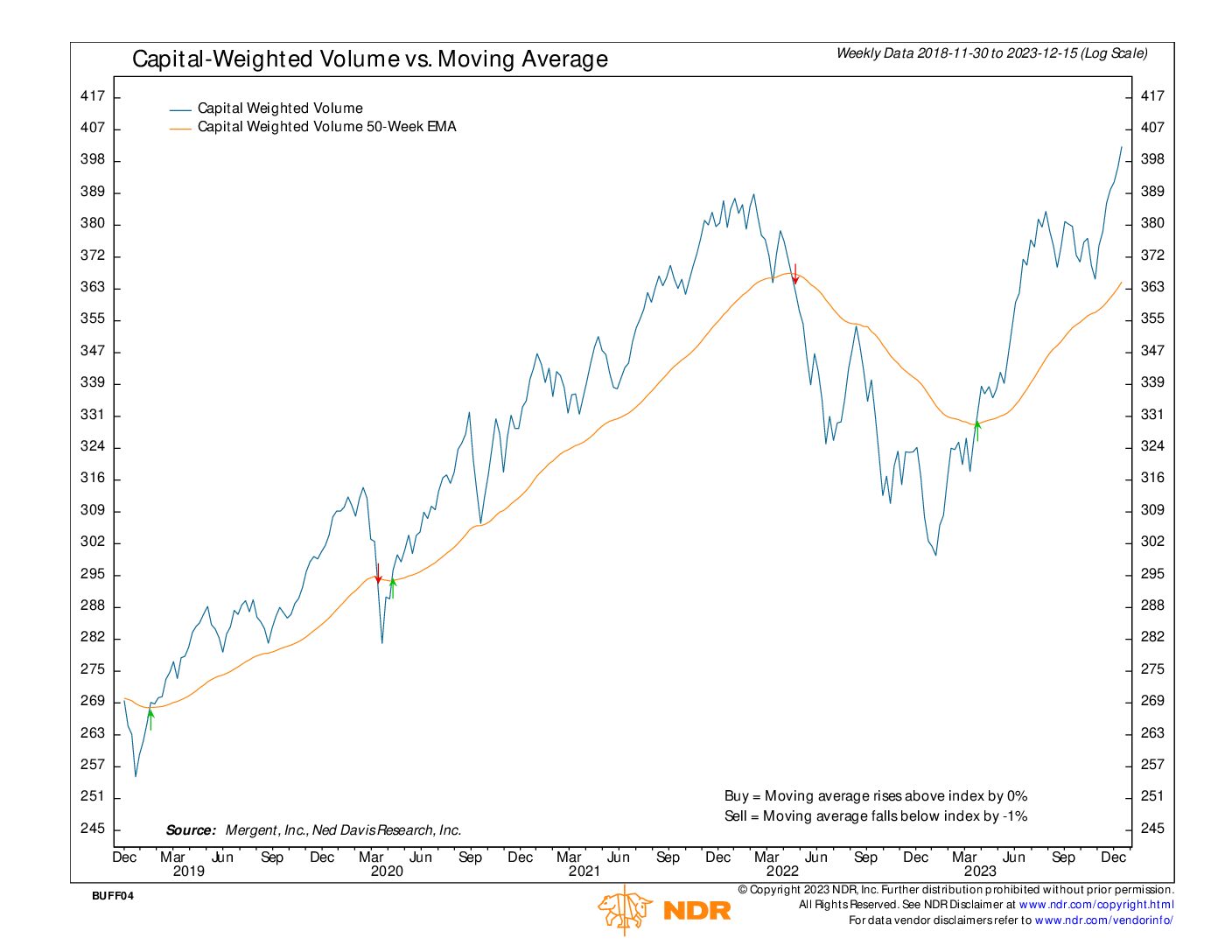

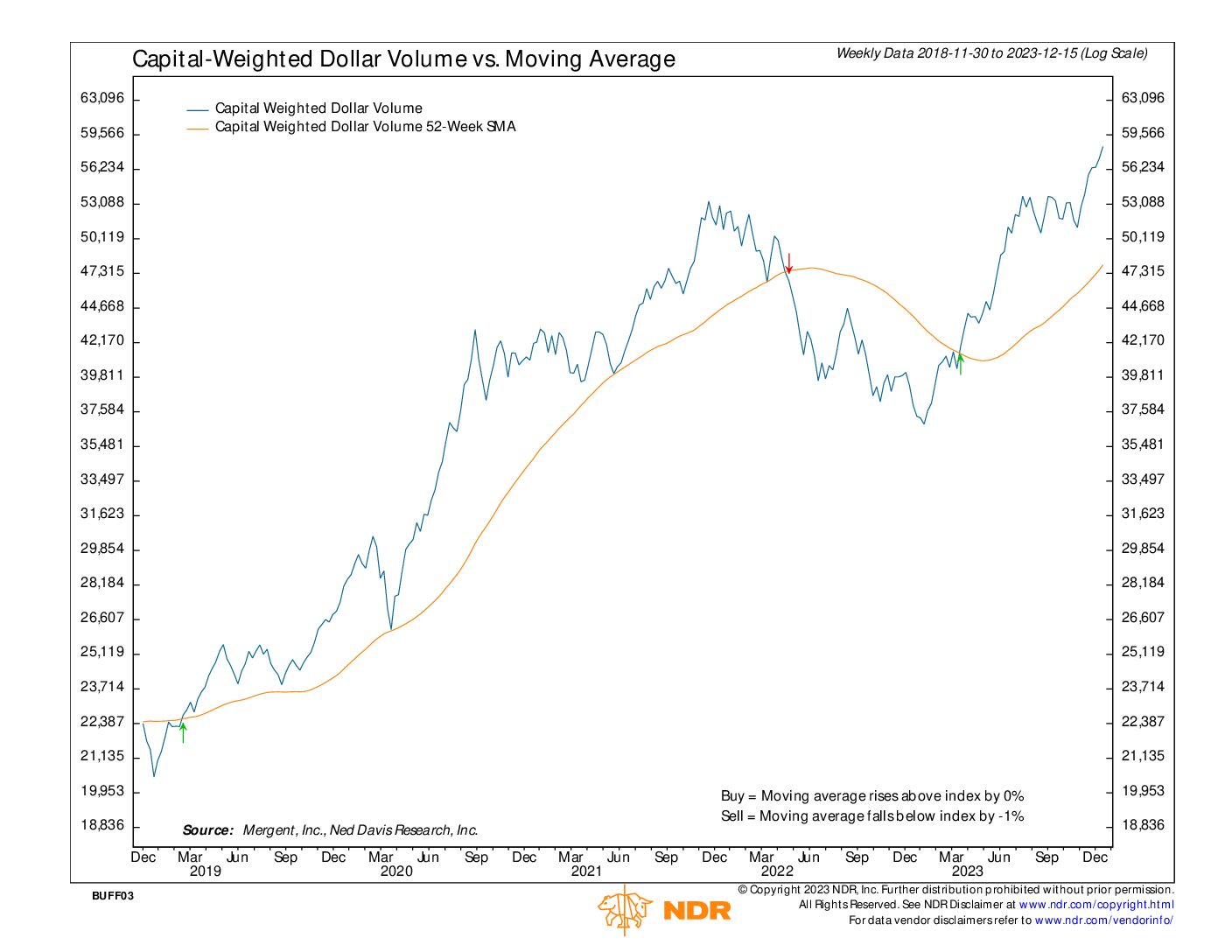

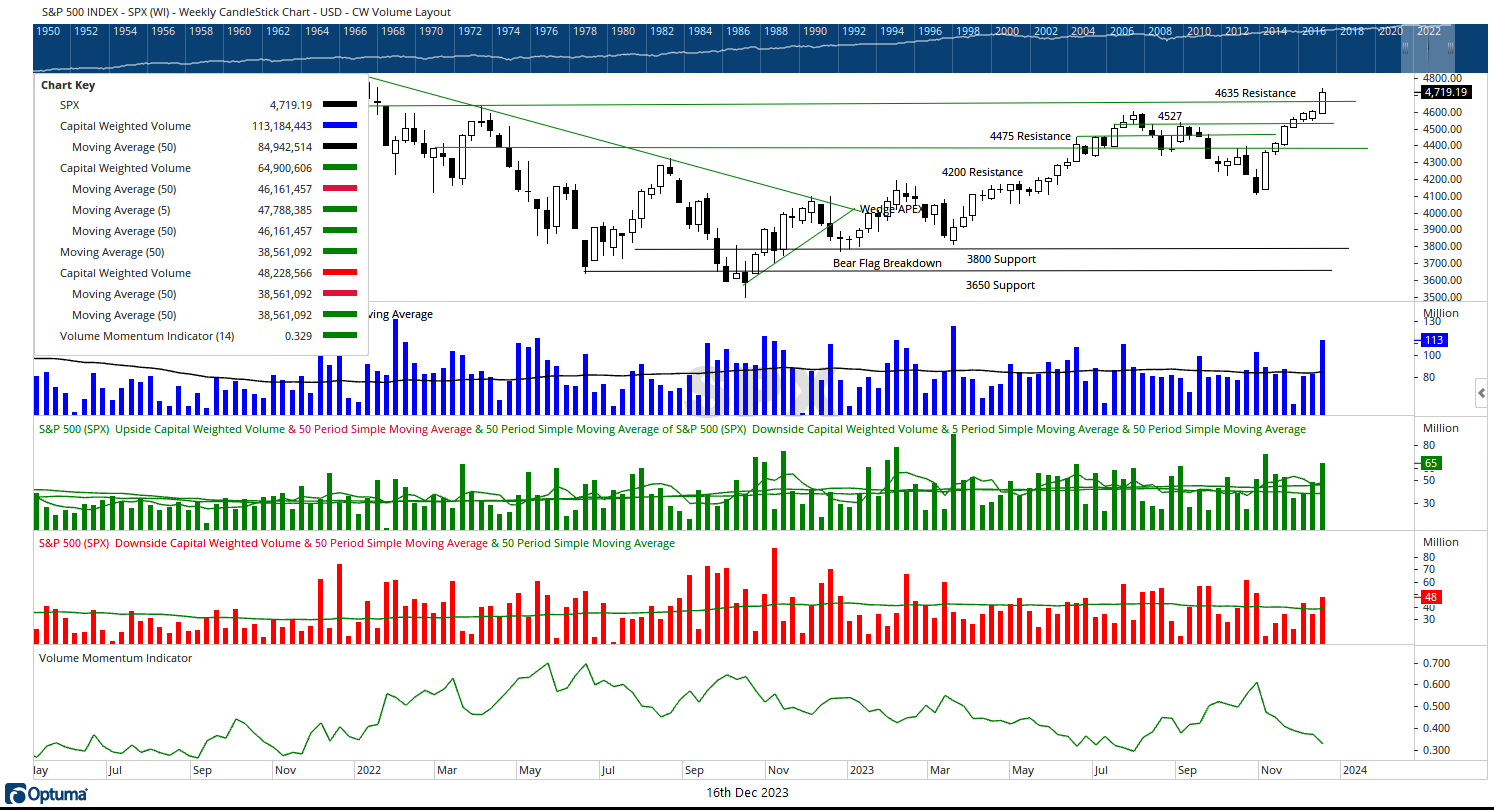

The S&P 500 Capital Weighted Volume experienced a significant surge this past week, witnessing over $113 billion in net flows, marking one of the highest readings of the year. Capital inflows surpassed outflows, registering $65 billion compared to $48 billion. Both upside and downside Capital Weighted Dollar Volumes surpassed their average weekly volumes.

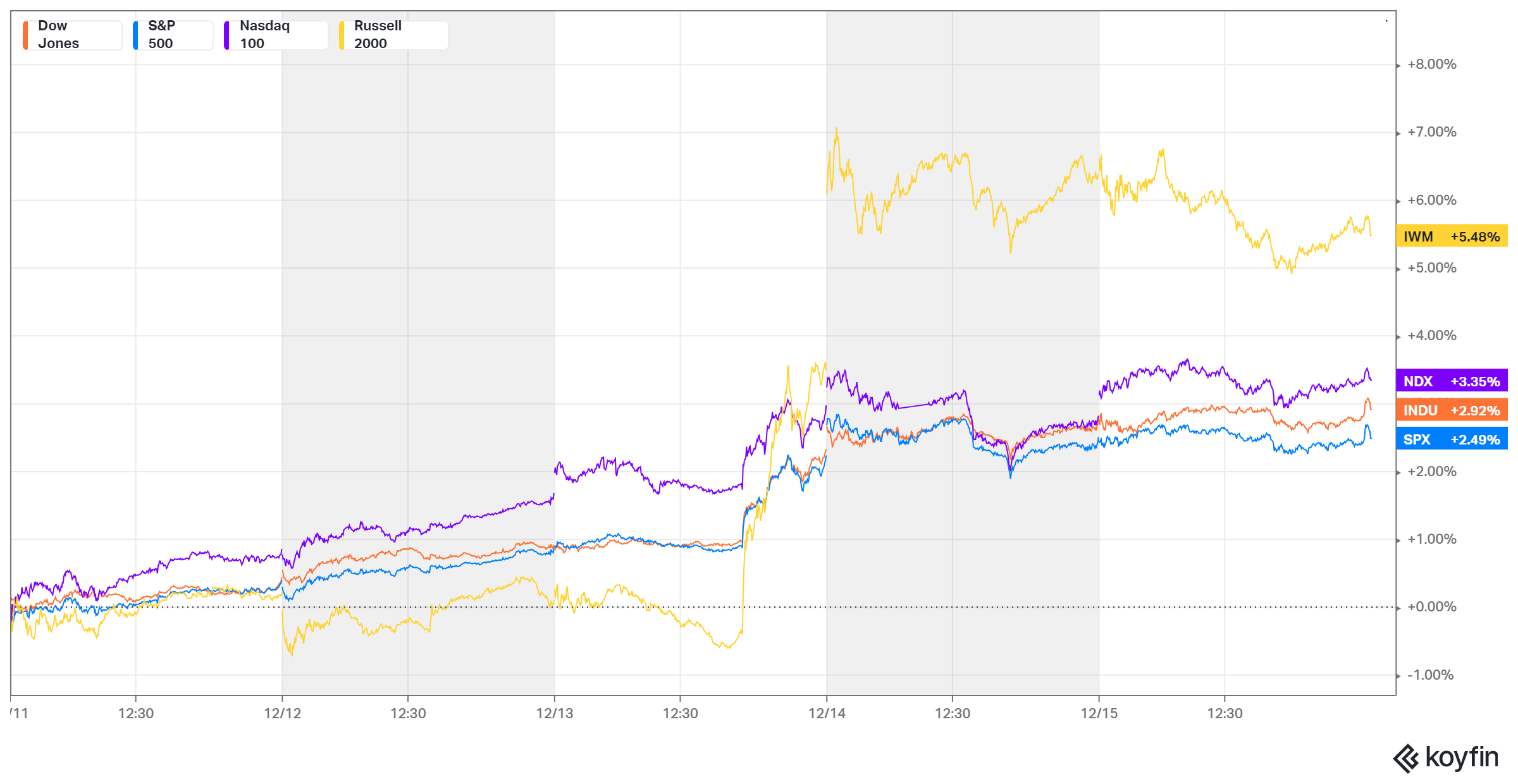

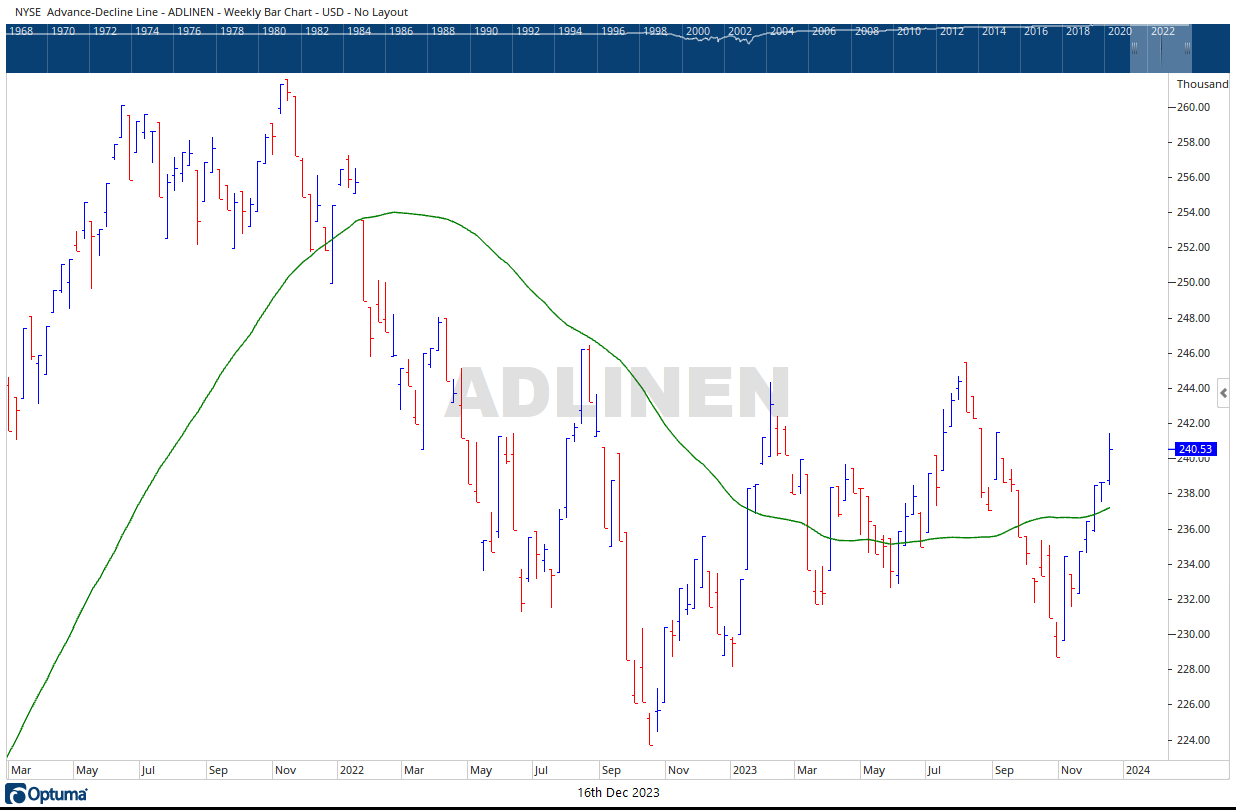

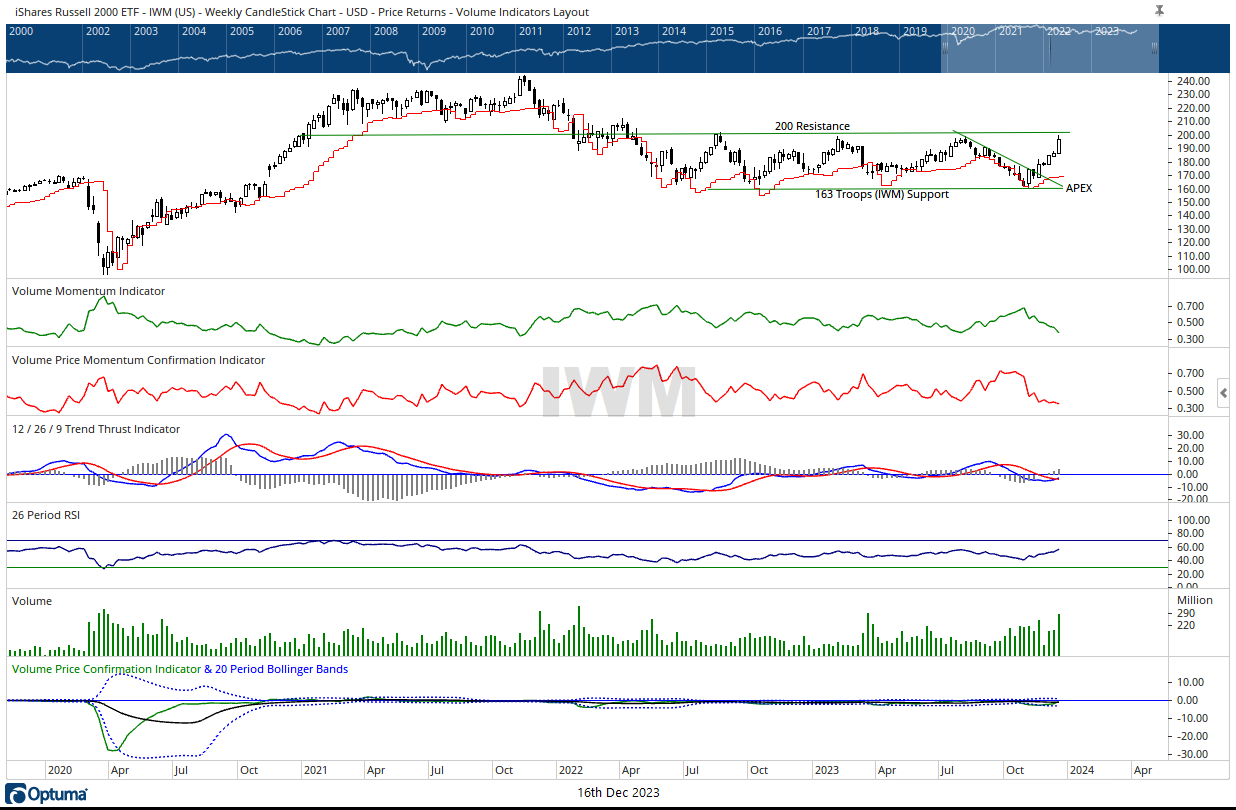

Furthermore, both S&P 500 Weighted Volume and Capital Weighted Volume achieved weekly all-time highs once again. Market breadth demonstrated strength, with the NYSE Advance-Decline line surging, albeit still below its July highs. Overall, the S&P 500 closed the week with a 2.49% gain, trailing behind the NDX 100 (generals) which recorded a 3.35% increase, and the formerly struggling IWM (troops), which saw a notable 5.48% gain.

While the surge in the troops is viewed as constructive for the long term, IWM faces formidable resistance at 200 once again. Over the past two years, each time IWM approached this level, it has retraced, including instances in July 2022, January 2023 and July 2023. Given the rapid magnitude of the recent surge, a period of consolidation may be necessary before attempting to overcome this resistance level.

The S&P 500 encounters resistance only about 2% away from its all-time highs in the 4800s, while support rests at 4600. Both Capital Weighted Volume and Capital Weighted Dollar Volume lead the price indexes higher, indicating a potentially healthy market. However, the earlier theme of broadening out in the market, predicted at the quarter’s beginning, may have largely played out. Nonetheless, if IWM successfully breaks through 200 resistance, it could signal a unification of the troops with the generals, fostering a bullish market sentiment.

Shared content and posted charts are intended to be used for informational and educational purposes only. CMT Association does not offer, and this information shall not be understood or construed as, financial advice or investment recommendations. The information provided is not a substitute for advice from an investment professional. CMT Association does not accept liability for any financial loss or damage our audience may incur.