Update

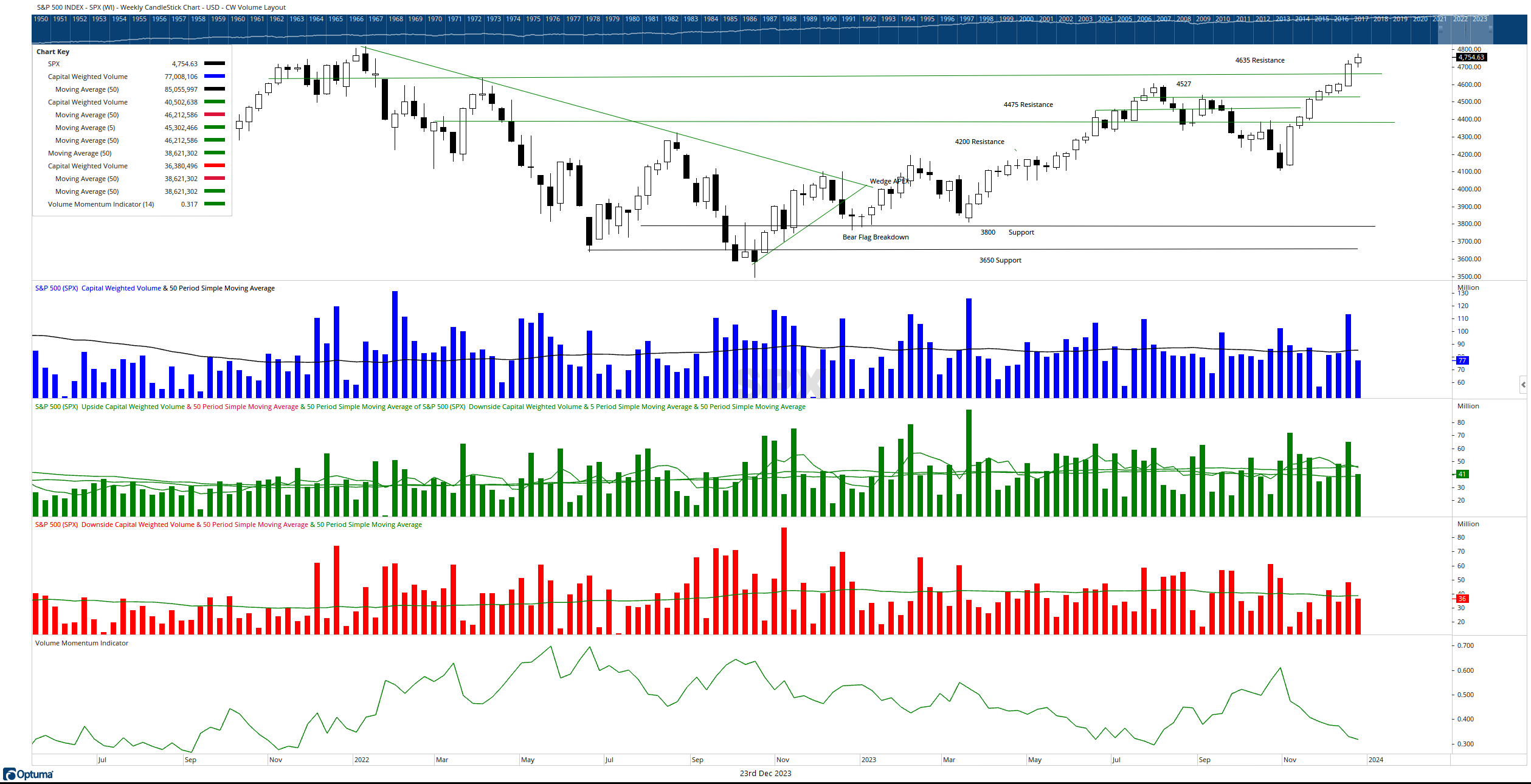

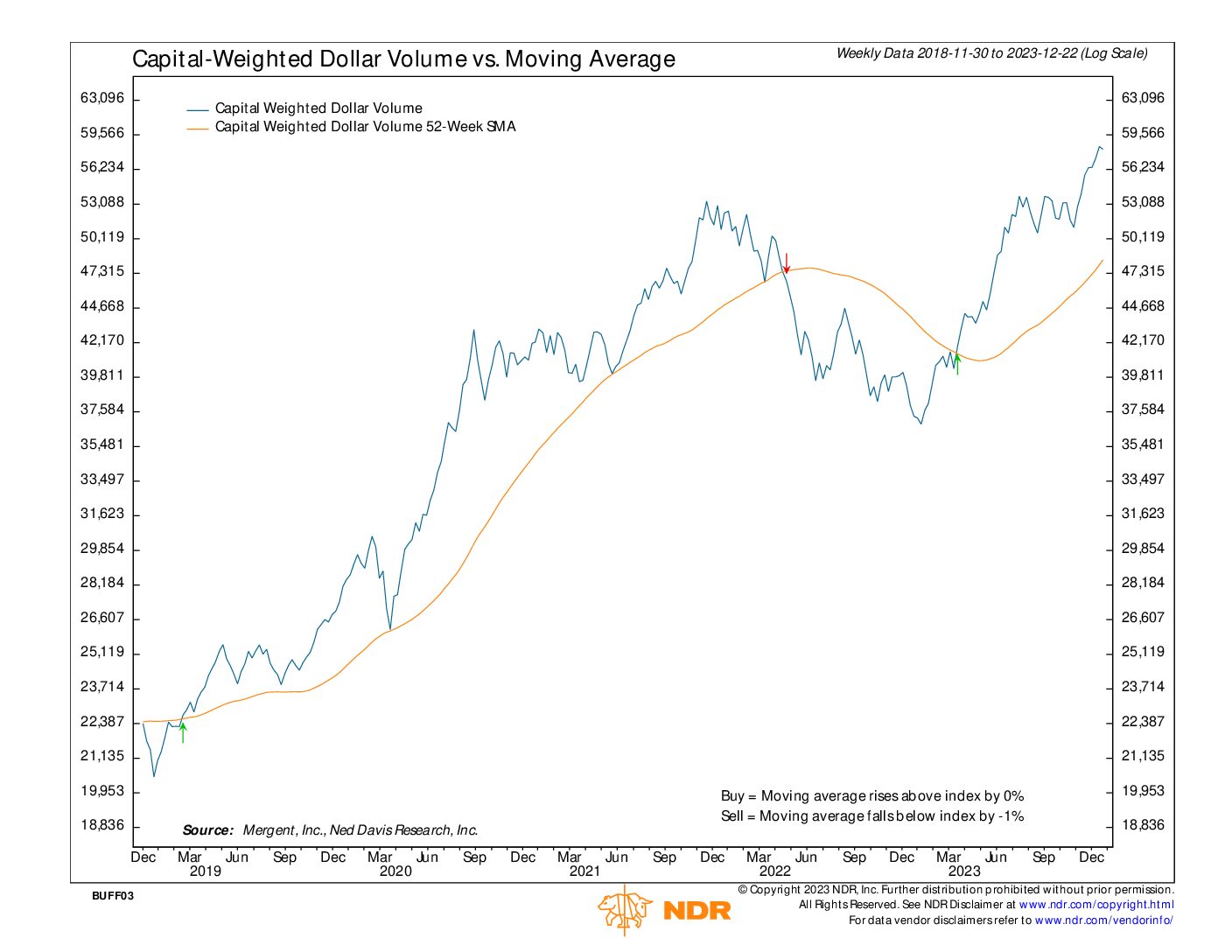

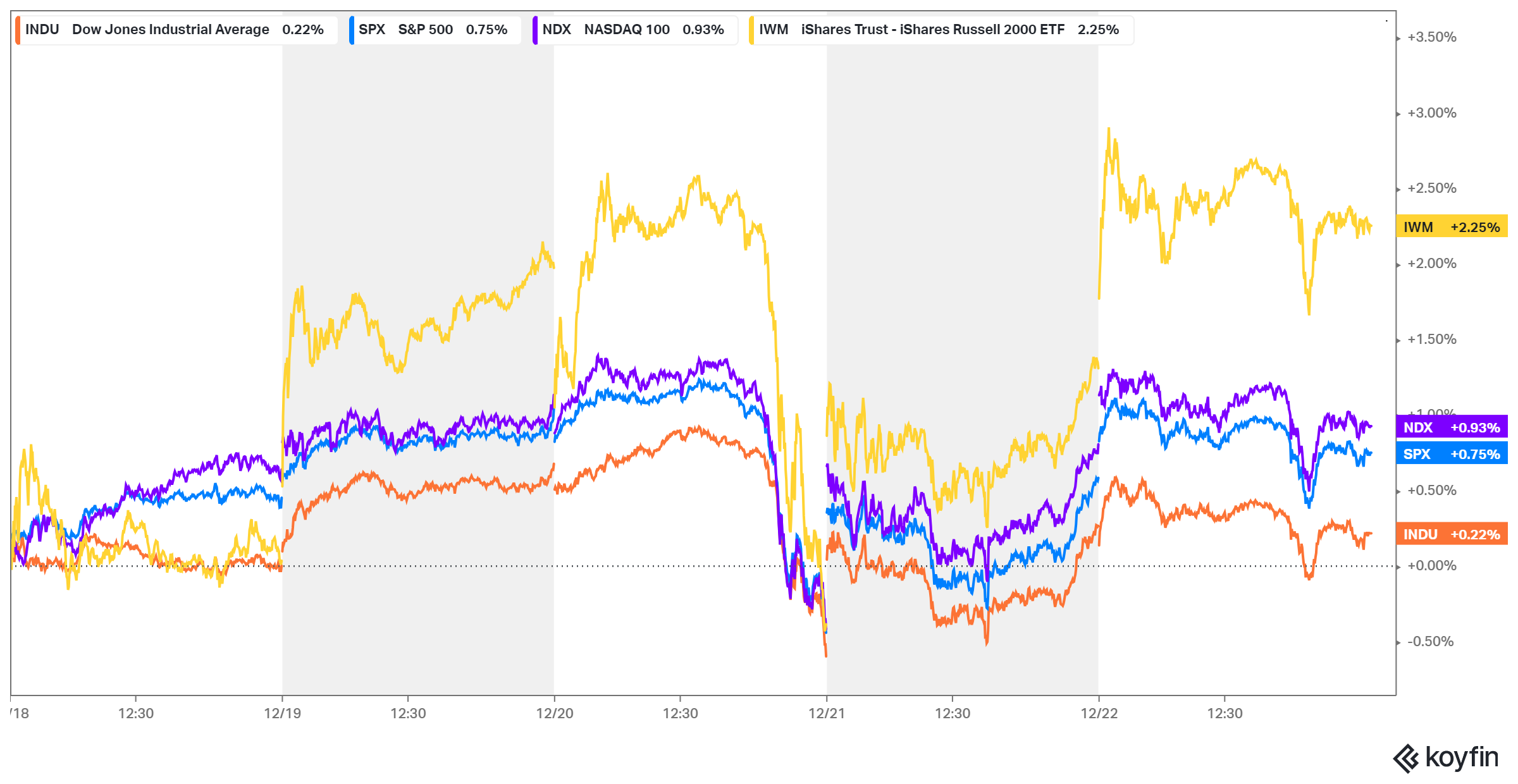

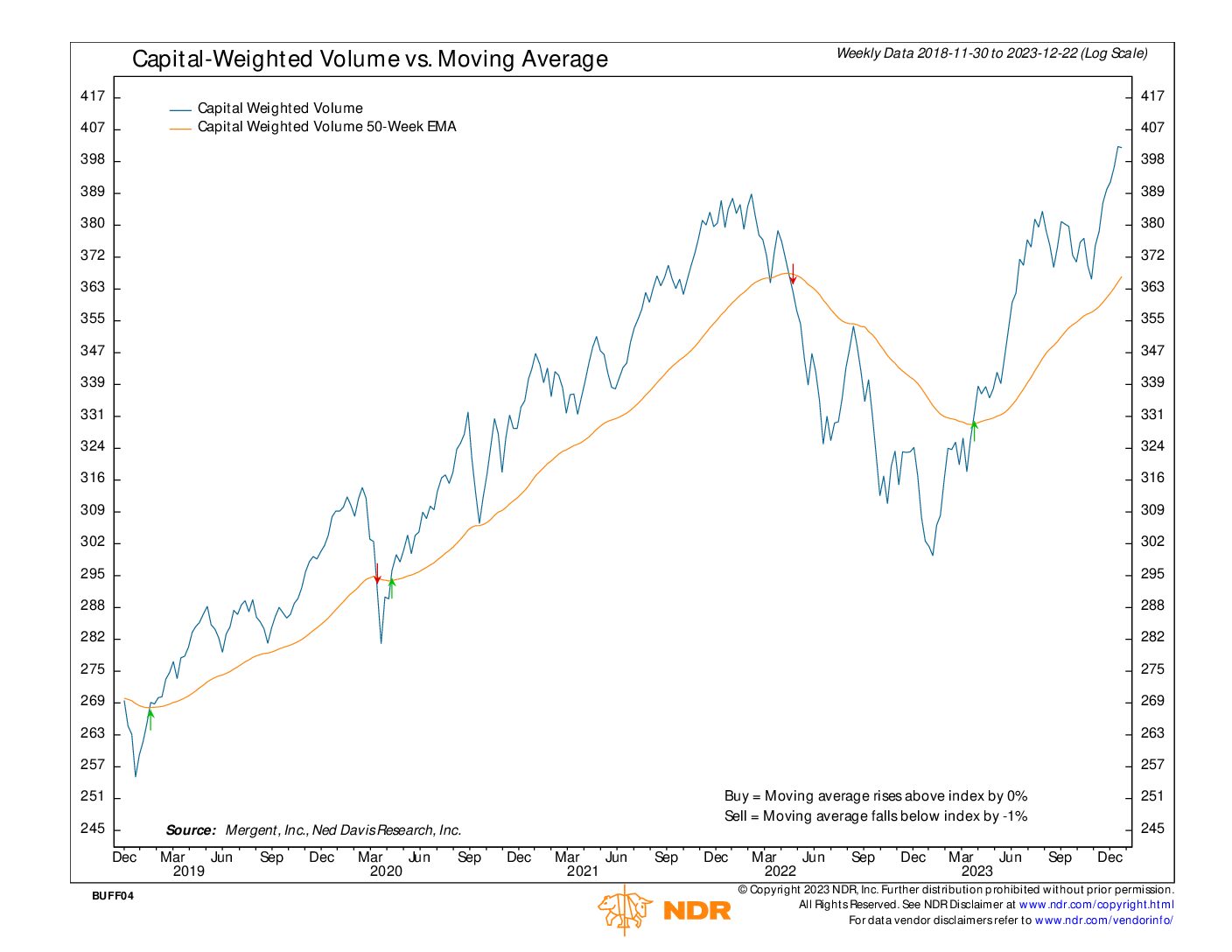

Capital-weighted dollar volume flows remained light for the week, with capital inflows totaling an average dollar volume of $40.5 billion, while capital outflows were relatively modest at $36.4 billion. Once again, both Capital Weighted Volume and Dollar Volume closed near all-time highs. The S&P 500 closed the week with a 0.75% gain, outpaced by the generals (NDX 100) with a 0.93% increase and the surging troops (IWM) which increased by 2.25%. Meanwhile, market breadth, as measured by the NYSE Advance-Decline Line, continues to support the price advance with a notable surge within the trading range.

The market’s expansion is evident, marked by the sudden participation in previously lagging sectors such as small-cap stocks. IWM closed the week at a resistance level (201) on above-average volume. From a technical standpoint, the battle of small caps at this resistance level is a key focal point. Despite a 24% increase since their November lows, small caps still significantly trail behind the S&P 500. A breakout above IWM 202 would bring the markets into a state of bullish harmony, but a temporary pause for consolidation may also prove beneficial in the long run.

Shared content and posted charts are intended to be used for informational and educational purposes only. CMT Association does not offer, and this information shall not be understood or construed as, financial advice or investment recommendations. The information provided is not a substitute for advice from an investment professional. CMT Association does not accept liability for any financial loss or damage our audience may incur.